- Summary:

- Canadian CPI data came in flat at 2.0%. Focus now shifts to the EIA Crude Inventories Report, which could provide intraday direction for USDCAD.

Canadian CPI came in at 2.0%, which matched the consensus figures. This result did not produce the required deviations which would have made it possible to trade the USDCAD based on the news.

News Trade Triggers

A 0.1% deviation to the downside (i.e. CPI of 1.9% and below) would have caused the USDCAD to spike upwards by at least 40 pips in the first 10 minutes, followed by a move of at least 60 pips within 4 hours of the news release. A 0.1% deviation to the upside (i.e. CPI of 2.1% and above) would have been good for a 60-pip downward spike in 10 minutes, followed by a 75-pip drop in the USDCAD over 4 hours.

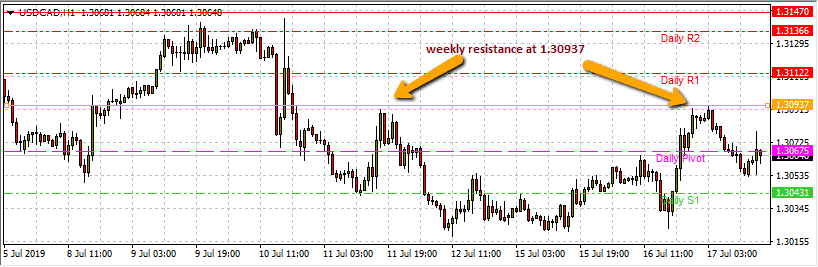

However, these expectations were not met and the USDCAD did what most currency pairs do when news trade expectations are not met: enter into whipsaw movements. This is presently being seen on the USDCAD charts.

What Lies Ahead?

An inflation rate at or above the 2% target range would allow the Bank of Canada continue with its rate holding stance. This would allow the divergence in interest rate policy between the US and Canada to be maintained, which would technically limit any massive upside rebounds.

The USDCAD would therefore look towards the EIA Crude Inventories Report at 2.30pm GMT for short-term direction, even as the USDCAD remains in a long-term downtrend.

Opportunities to sell on rallies would be the way to go. Presently, the 1.30937 and 1.31122 are the immediate resistance areas. If any upsides from the EIA report are noted, these may be the areas to watch. Failure of any rallies to breach these points would cause a resumption of the downtrend. 1.30937 is especially significant as it is the 61.8% retracement from the July 9 swing high to the July 12 swing low.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.