- Summary:

- Canada unemployment data disappoint, with unemployment rate rising unexpectedly to 5.7% and mor ethan 224,000 jobs cut from the workforce.

According to Statistics Canada, Canadian unemployment rose to 5.7% in July, which was higher than the market expectation of 5.5%. Furthermore, the total number of people that were employed within the period under review fell by 24,200, which was worse than the previous month’s number of 2,200. Participation rate dropped to 65.6%. However, the US Core Producer Price Index fell by 3points from the expected figure and 4 points from last month’s 0.3% figure.

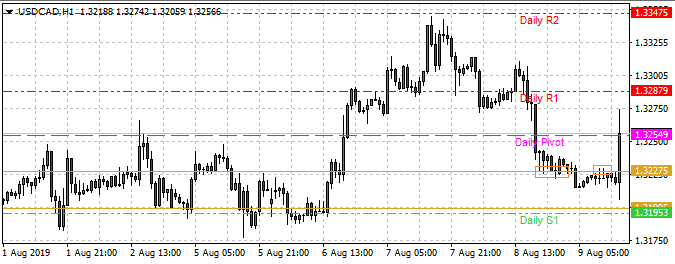

Both news releases hit the newswires at the same time, causing a 55-pip spike in the USDCAD. However, the news from the US seems to have limited the extent of the price spike

The news has only been out a few minutes, so we will see buyers and sellers jostling for positions on the USDCAD, which should create some back-and-forth movement on the pair. However, this news is CAD negative, so traders should look for possible areas to buy on the dips. The 1.3230 stands out (yesterday’s S2 pivot) as a good area for a possible dip buy, using the intraday pivot points located above this point as possible price targets.

The CAD has not had a very good week as oil prices have been largely trading lower from last week’s levels. This news release will ensure that the USDCAD will probably end the week slightly higher than it started it.