USDCAD trades 0.07% higher at 1.3252 as traders turn their attention to the Fed decision later today. On the macro front, the United States Housing Starts Change came in at 12.3%, above forecasts (4.5%) in August, Building Permits Change fell from previous 8.4% to 7.7% in August. In Canada, the CPI (year over year) came in at 1.9%, below expectations of 2% in August. Crude oil prices Canada’s main export commodity, trading 1.77% lower at 58.29 per barrel.

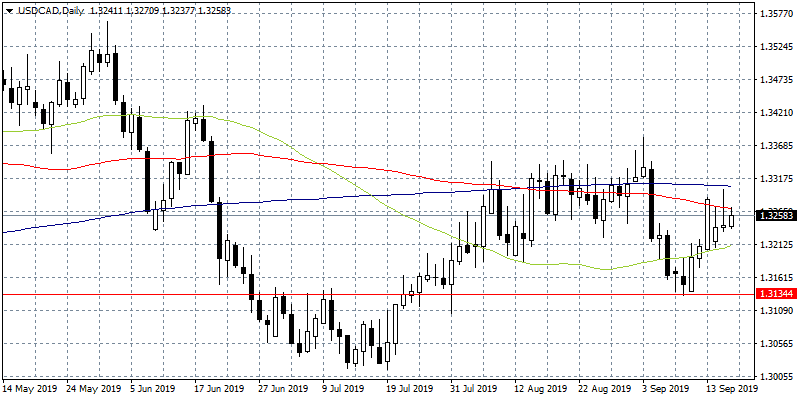

USDCAD tested earlier today the 100-day moving average but failed to break higher. On the upside, immediate resistance stands at 1.3270 the daily high while more offers will emerge at 1.3304 the 200-day moving average. On the downside, the pair formed a strong support zone at 1.3134 which tested successfully for three days in a row in early September. Intraday, immediate support for the pair stands at 1.3237 daily low while more bids will emerge at 1.3211 the 50-day moving average before the next barrier at 1.3176 the low from September 12th.