- Summary:

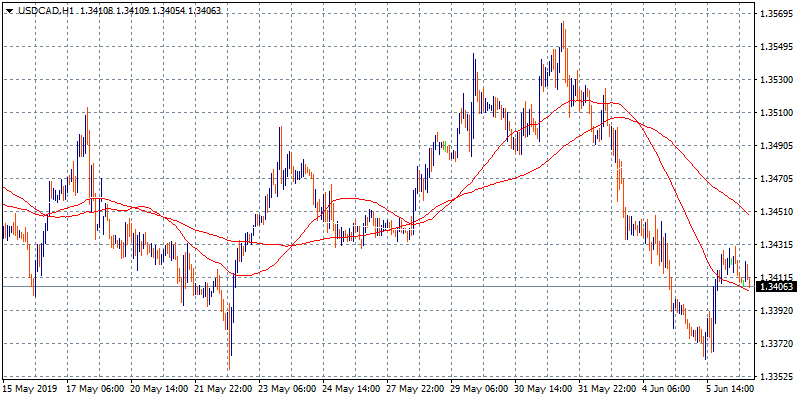

- The pair rebounds today breaking above the 1.34 level and trading as of writing at 1.3416 amid USD strength across the board

The pair rebounds today breaking above the 1.34 level and trading as of writing at 1.3416 amid USD strength across the board and as the retreat in crude oil prices, (to multi month lows) Canada’s main export item, seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at the 100 day moving average around 1.3345 while extra support stands at 1.3300 round figure. On the upside immediate resistance stands at the 1.3451 mark the 100 hour moving average before an attempt to 1.3466 where the 200 hours moving average stands.

On the fundamental side, traders expect the Fed to cut interest rates twice in the next six months. Powell’s comments sparked a huge rally on equities, lifted U.S. Treasury yields and underpinned the Canadian dollar. Recent macro data has been reasonably supportive for the CAD, but Canada’s economy is also suffering from the impact of USA – China trade war and US – Mexico tariff conflict. Loonie traders will be closely watching the important release of the US monthly jobs report (NFP) tomorrow.