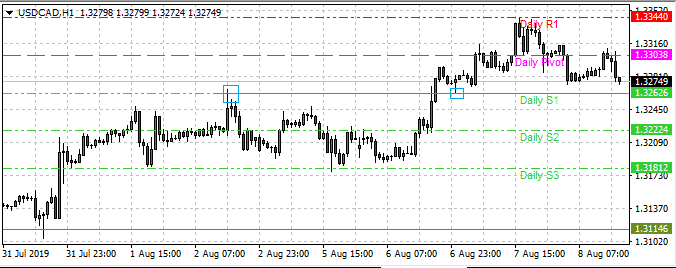

The Canadian Dollar hit an intraday low against the US Dollar as oil prices could not muster a significant overnight rally. Consequently, the USDCAD traded at 1.3344 before correcting to the 1.3263 price level. Since then, most of the intraday trading for the day has swung between the S1 pivot at 1.32730 below and 1.3304 acting as the price ceiling for the trading range.

The USDCAD has gained 130 pips this week on the back of falling crude oil prices triggered by the weakening of the Yuan against the US Dollar. The situation has since stabilized as the PBOC has walked back on its Yuan actions and has also rejected President Trump’s label of “currency manipulator”. The EIA crude oil inventories also showed a greater than expected stockpile of crude, keeping a lid on prices.

Intraday Technical Plays for USDCAD

Intraday resistance continues to lie at the 1.3340 price level while support lies at 1.3263. Barring any fundamental influences and if current support/resistance levels hold firm, range traders will find some joy buying off support or selling off resistance.

An upside break of 1.3344 with at least a 1% penetration or a double hourly candle close will blow open a pathway to the 1.3385 resistance, and 1.3425 beyond that. Conversely, a break of the major support at 1.3275 will target the 1.3222 and 1.3181.