- Summary:

- The USDCAD pair has had a muted response to the Canadian monthly GDP data as well as the ADP Employment Change figures. What lies ahead for USDCAD?

The USDCAD has had a muted response to the Canadian monthly GDP data as well as the ADP Employment Change figures, which both did not deliver any major surprices. Canadian GDP came in at 0.2%, which was only marginally better than the market had expected. The market consensus stood at 0.1% while the previous figure was 0.3%. The ADP Employment Change came in at 156,000 job additions to the US economy, which was only marginally higher than the 150,000 than the market had expected for this news release.

The USD was unmoved by the bland ADP data, and the fact that the Canadian monthly GDP data did not meet the earlier described deviation (0.2%) was enough to produce only a 20-pip gain by the Loonie over the greenback.

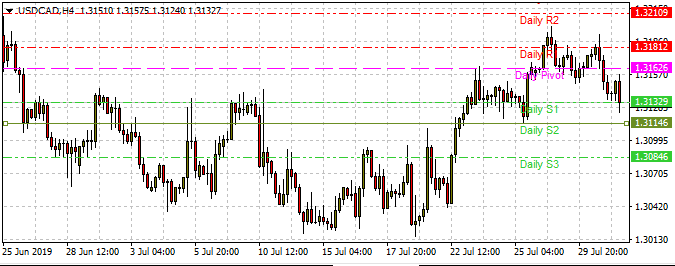

Presently, the USDCAD’s decline has been halted at the S1 daily pivot support, even though active price candle continues to test this level.

If the CAD is able to breach the S1 pivot, it will find support at S2 prior to the FOMC decision. If the S1 support holds, expect the pair to continue trading within the range formed by the central pivot as ceiling and S1 as the floor.

Expect a bigger price move after the FOMC decision. Such price moves could go either way and will depend on the rate decision as well as the contents of the rate statement.Don’t miss a beat! Follow us on Twitter.