- Summary:

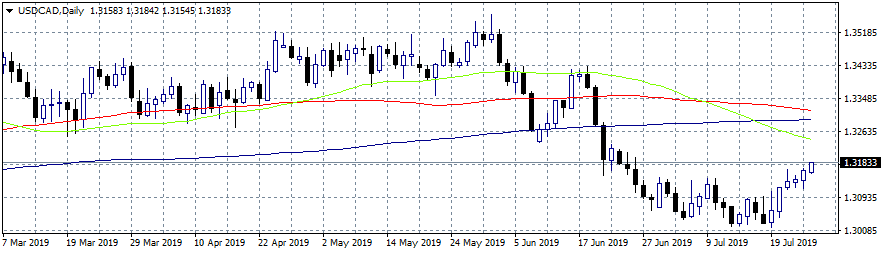

- USDCAD trades 0.03 percent higher at 1.3166 in positive momentum for sixth consecutive day, having the daily high at 1.3167 and the daily low at 1.3154

USDCAD trades 0.03 percent higher at 1.3166 in positive momentum for sixth consecutive day, having the daily high at 1.3167 and the daily low at 1.3154. USD continues to attract bids as investors have cut their interest rate cut expectations to 25 basis points by Fed next week. Crude oil Canada main export product has stabilized around $56 per barrel. The USD index is trading higher across majors all the week ahead of the FOMC decision next week.

USDCAD hit fresh 9 month lows at 1.3017 amid USD weakness across the board as markets discounted a 50 basis point cut by FED at the end of the month policy meeting.

Bulls are control for the short term as the pair trading above all major hourly moving averages. On the downside first support stands at 1.3114 the low from yesterday and then at 1.3092 the 200 hour moving average. Immediate resistance for the pair stands at 1.3166 the yesterday’s high, and then at 1.3241 the 50 day moving average. Long positions are probably safe as long as the pair trades above the 1.31 mark.Don’t miss a beat! Follow us on Twitter.