USDCAD gives up 0.12 percent to 1.3072 after stronger than expected figures from Canada. The GDP growth in April came in at 0.3% beating the analyst’s expectation of 0.1%, previous figure was at 0.5%. The Bank of Canada Business Outlook Survey for the 2Q 2019 noted a slight improvement in the Canadian business sentiment and investment and employment opportunities continue strong. Above that the United States Chicago Purchasing Managers’ Index came at 49.7 below markets expectations of 53.1 for June. The University of Michigan’s Consumer Confidence Index came in at 98.2 for June and beating analyst’s forecasts of 98. The mixed data from the U.S. economy failed to attract any bids in USD. USDCAD traders will closely follow the discussions in G20 meeting which started in Osaka for developments in China – USA trade war. Next week we have the important OPEC meeting which will drive oil prices and affect the Canadian dollar.

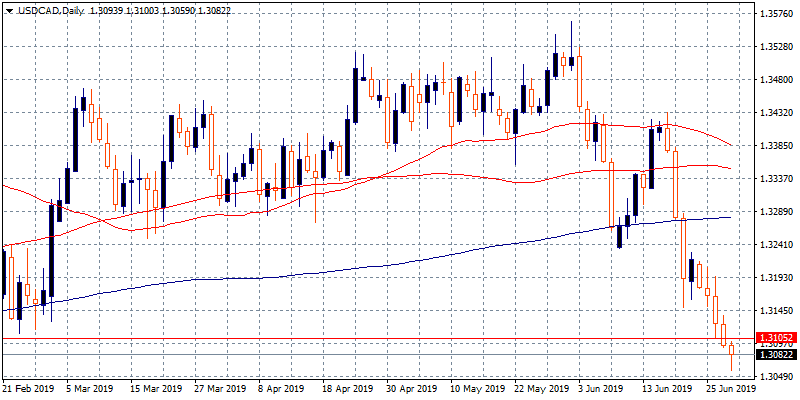

Bears are in full control as the pair trading below all the major daily moving averages. Today the pair breached the low at 1.3068 from February, and reached the daily low at 1.3059. First support stands at 1.3044 the low from October 2018 while more bids will emerge at 1.30 psychological level. Immediate resistance for the pair stands at 1.31 the daily high while a break above might trigger some aggressive buying, sending the pair to the next resistance at 1.3144 where the 100 hour moving average cross.Don’t miss a beat! Follow us on Twitter.