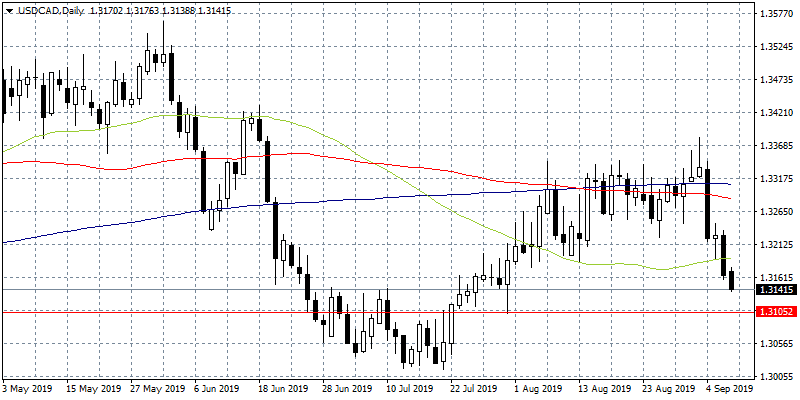

USDCAD trades 0.17% lower at 1.3141 as correction continues after Bank of Canada left interest rates unchanged at 1.75% as widely expected by markets the previous week. The August survey of Consumer Expectations of NY Fed showed one-year inflation expectations down 0.2% points to 2.4%, the lowest reading since 2013; The three-year survey fell to 2.5% from 2.6%. Crude oil prices, Canada’s main export product, jumped 2.74% higher at $58.07 per barrel, giving a boost to Loonie.

Bulls are in control now as USDCAD trades below all major daily moving averages. On the downside immediate support for the pair stands at 1.3138 daily low while more bids will emerge at 1.3104 the low from July 31st. Immediate resistance for the pair now stands at 1.3176 today’s high, and then at 1.3285 the 100-day moving average.