- Summary:

- USD/ZAR price retreated slightly on Monday morning as investors focused on the upcoming interest rate decisions by the Fed and SARB

The USD/ZAR price retreated slightly on Monday morning as investors focused on the upcoming interest rate decisions by the Federal Reserve and SARB and American jobs data. It is trading at 16.32, which is slightly below last week’s high of 16.50. The South African rand is still about 7.65% below its highest point in June.

Rsk-off sentiment

The USD to ZAR price has been in a strong bullish trend in the past few weeks as the dollar strength gains steam. The US dollar index has jumped sharply and is currently trading at $105 as investors embrace a risk-off sentiment. This is evidenced by the performance of the CBOE VIX, which has risen, and the fear and greed index, which has fallen recently.

The next key catalyst for the USD/ZAR price will be the American jobs data that are scheduled for Friday this week. Analysts expect these numbers to reveal that the country’s unemployment rate dropped back to about 3.5% in June. They also expect these numbers to reveal that hiring slowed down as business and consumer confidence dropped.

The USDZAR price will also react to the latest PMI numbers from South Africa and the US. These are important numbers that show the performance of key sectors like mining, manufacturing, and services. Expectations are that business activity held steady in June even as companies continued battling the soaring inflation.

USD/ZAR prediction

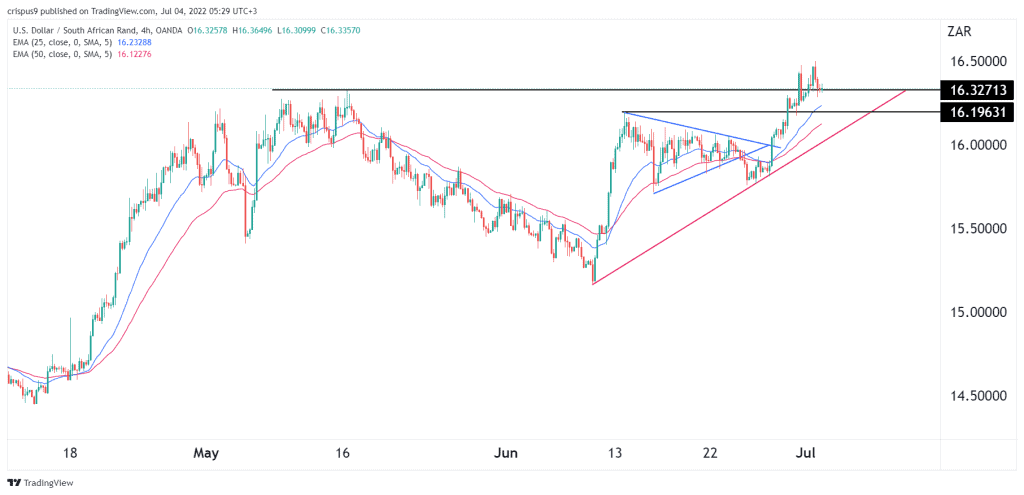

The four-hour chart shows that the USDZAR price has been in a strong bullish trend in the past few weeks. Along the way, the pair formed a symmetrical triangle pattern that is shown in blue. It made a bullish breakout and rose to a high of 16.50. The pair remains above the 25-day and 50-day moving averages.

And now, it is forming a break and retest pattern since it has retested the support at 16.32, which was the highest point on May 16th. Therefore, the pair will likely resume the bullish trend in June as bulls target the key resistance at 17.0. This is in line with my previous forecast for the South African rand. A drop below the support at 16 will invalidate the bearish view.