- Summary:

- The USD/TRY is capped by a resistance below 18 Lira, but will Russia's purchase of the Lira as part of the NWF save the currency?

The USD/TRY is holding on to marginal gains this Monday as the price action on the pair continues to trade within very narrow ranges due to low volume trading. Price action on the USD/TRY has been capped by the resistance that lies just below the 18 Lira price mark.

The Lira’s weakness comes from the latest budget figures indicating a deficit of 64 billion ($3.56 billion) in July, leaving a primary deficit of 47.3 billion Lira. The budget presently has a surplus of 29.5 billion Lira for the first seven months of 2022, according to data from the Turkish Finance Ministry released on Monday.

However, the Lira could soon get a reprieve if Russia’s decision to move away from the US Dollar as the main currency store in its sovereign wealth fund is anything to go by. A report from CNA quotes the Russian central bank as saying it would buy currencies of countries it considers “friendly” nations as part of its National Wealth Fund.

The move, the apex bank says, has become imperative as it can no longer buy dollars or euros due to the ongoing economic sanctions. The Turkish Lira, Chinese Yuan and Indian Rupee are considered as the top candidates. The three countries have not been critical of the invasion of Ukraine.

From a technical analysis standpoint, the USD/TRY is pushing hard against the 17.96991 resistance. Further pressure could force the lid off the price action, which threatens to send the Lira to new all-time lows. However, if Russia goes ahead with its plans of buying the Lira as part of a currency basket for its rainy day fund, the embattled currency may get a reprieve.

USD/TRY Forecast

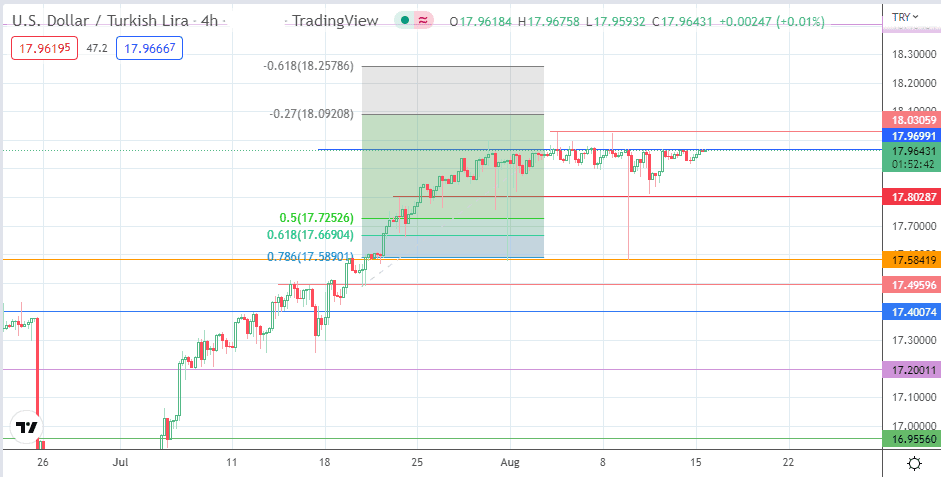

The resistance at 17.96991 caps the price action and remains the barrier to beat for the bulls. A break of this resistance allows for a potential run toward the 18.03059 resistance (3 August and 8 August highs). Above this level, the all-time high at 18.40484 beckons, but not before a potential brush with the 18.09208 and 18.25786 price levels, being the 27% and 61.8% Fibonacci extension levels of the price swing from the 20 July low to the 29 July high.

On the other hand, rejection at 17.96991 allows for a dip that touches off the 17.80287 support level (22 July high). If the bulls fail to defend this support, a further correction towards the 17.58419 price pivot will ensue. This move must overcome the 61.8% Fibonacci retracement support level at 17.66904, formed by the 22 July low. 17.49596 forms another harvest point for the bears if the price deterioration on the pair continues.

USD/TRY: 4-Hour Chart