- Summary:

- The USD/TRY has surged to a record high as investors wait for the latest CBRT interest rate decision. The pair is trading at 14.80

The USD/TRY has surged to a record high as investors wait for the latest CBRT interest rate decision. The pair is trading at 14.80, which is a few points below its all-time high of 15. Similarly, the GBP/TRY and EUR/TRY have surged.

CBRT interest rate decision

The Turkish lira has gotten more worthless in the past few months. The currency has depreciated by about 100% this year alone as investors reflect on the irrational policies implemented by the Central Bank of the Republic of Turkey (CBRT).

Ideally, central banks tend to tighten monetary conditions when inflation is rising. By so doing, they limit the amount of cash in circulation and pressure prices to decline.

The CBRT has gone against this after it slashed interest rates three times this year. The bank’s governor has ignorantly claimed that low-interest rates will likely bring inflation down. Recent data showed that inflation rose by 21% although an independent report placed the figure at 58%.

The USD/TRY will react to the latest CBRT decision. Analysts expect that the bank will slash interest rates by 100 basis points in this meeting. This means that there is a strong divergence between the CBRT and the Fed. In its meeting this week, the Fed hinted that it will hike interest rates three times and end QE in March.

Therefore, as the Turkish lira declines, and as US interest rates start rising, Turkey could be at risk of default unless the CBRT intervenes.

USD/TRY forecast

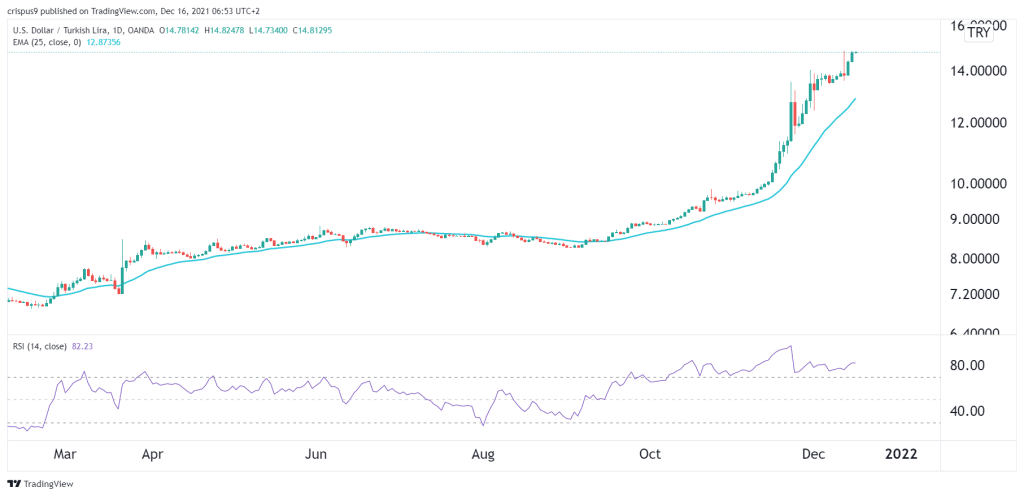

The daily chart shows that the USD/TRY pair has been in a strong bullish trend with no end in sight for the Turkish lira crash. As a result, the pair remains above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) remains slightly above the overbought level.

While the outlook for the pair is bullish, there is a likelihood that it will have a pullback if the CBRT cuts rates as investors sell the news. This could see it retest the support at about 13. In the long-term, however, the overall trend is bullish.