- Summary:

- The USD/TRY price retreated to the lowest level since January 4th as investors reacted to the latest US inflation data.

The USD/TRY price retreated to the lowest level since January 4th as investors reacted to the latest US inflation data. The Turkish lira is trading at 13.2 against the US dollar. On the other hand, the GBP/TRY and EUR/TRY pairs are trading at 18.4 and 15.12, respectively.

The USD/TRY pair declined as the US dollar declined broadly after the latest US consumer inflation data. The numbers showed that the headline CPI jumped to 7%, which was the highest level since 1982. The core CPI, which excludes the volatile food and energy prices, rose from 4.8% to 5.5%. The US dollar declined after that report because many analysts expect that inflation has peaked.

The Turkish lira will next react to the latest retail sales numbers from the country. The data will come in the morning session. Analysts are eager to see whether sales jumped in December after they rose by 15.25 in the previous month. Besides, the headline consumer inflation rose by about 30% in December.

A report published by the FT showed that the sell-off of the Turkish lira has pushed more people in Turkey to avoid the lira. Instead, they are now using foreign currency like the US dollar and stablecoins like Tether and USD Coin.

USD/TRY technical analysis

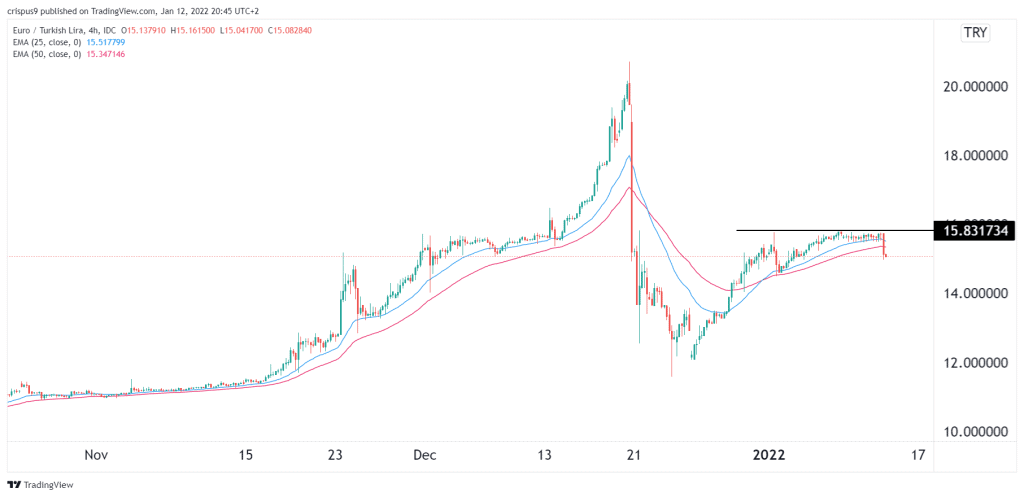

The four-hour chart shows that the USDTRY pair declined sharply on Wednesday after the latest US inflation data. The pair declined after it found a strong resistance at 15.83 level where it has struggled moving above several times this month. The pair also managed to move slightly below the 25-day and 50-day moving averages.

Therefore, the pair will likely continue the bearish trend as bears target the next key support level at 14.00. A move above the resistance at 15.83 will invalidate this view.