- Summary:

- The USD/TRY price crashed sharply on Tuesday as the Turkish government unveiled an “effective rate hike.”

The USD/TRY price crashed sharply on Tuesday as the Turkish government unveiled an “effective rate hike.” The Turkish lira roared back, rising by more than 40% against the US dollar. The GBP/TRY and EUR/TRY also jumped.

The Turkish government announced a new policy in its bid to curb the weakness of the lira. The government said that all Turkish savers will be compensated for all exchange-related losses. This new scheme will apply just to individuals and not businesses.

Also, these individuals will need to commit their savings in lira for about three months. For example, assume that Turkish saver deposits TRY1,000 and holds for one year. In this period, if the Turkish lira crashes by 14%, the government will cover the difference.

Analysts quickly noted that the new scheme was an effective backdoor rate hike. Some analysts warned that the new incentives to hold the lira could have significant consequences for the economy. For one, there are concerns about how the scheme will be funded. In a note, an analyst at Teneo said:

“This huge exchange-rate-indexed interest rate hike means that taxpayers will be financing the wealthy so that they will not lose on the [foreign exchange] front.”

In my view, these measures will only provide a short relief for the Turkish lira. Besides, the country is heading to an election that could see Erdogan put pressure on the CBRT to cut rates. There are also concerns about whether the Turkish residents will trust their government.

USD/TRY technical analysis

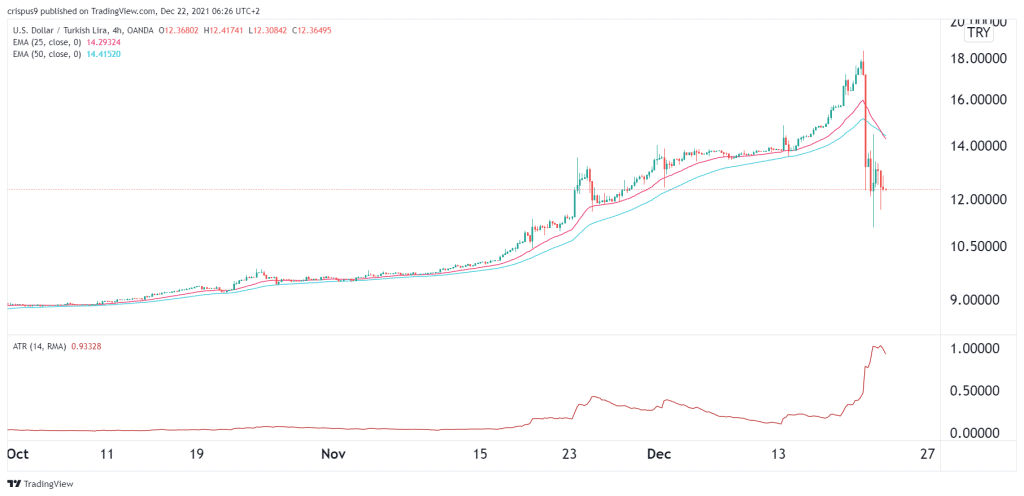

The four-hour chart shows that the USD/TRY has been in a parabolic rally recently. This rally has seen the Turkish lira crash to a low of 18. The situation turned around on Tuesday after the government announced the new measures.

It is trading at 12.37, which is about 32% below its all-time high. The pair has moved below the 25-day and 50-day moving averages while the Average True Range (ATR) has risen. This is a sign that the pair will be more volatile.

Therefore, there is a likelihood that the pair will drop further in the near term to about 10. But these losses could be limited in the near term.