- Summary:

- The USD/INR price has been in a strong upward trend even as the Indian economy emerges at a stronger pace than most emerging markets.

The USD/INR price has been in a strong upward trend even as the Indian economy emerges at a stronger pace than most emerging markets. USD to INR is trading at 77.56, which is slightly below its highest level this year. It has risen by more than 20% in the past five years and 4.2% year-to-date. So, what next for the Indian rupee?

The USD/INR pair has been in a strong upward trend as investors focus on the extremely hawkish Federal Reserve stance. The Fed has already started its tightening phase in the past few months. It has already hiked rates by 0.75% this year and is expected to deliver at least four hikes this year. As a result, the US dollar has been in spectacular growth, with the dollar index rising to the highest point in years.

The USD to INR pair has also risen even after the Reserve Bank of India (RBI) started hiking interest rates. The bank has made one rate hike in its bid to fight inflation, which stands at more than 7%. Minutes of this policy meeting that were published last week showed that the bank was likely to keep hiking interest rates.

There is no economic data scheduled from India expected this week. As a result, investors will focus on the upcoming Fed minutes and the speech by Jerome Powell. The US will also publish important economic data such as housing and GDP.

USD to INR forecast

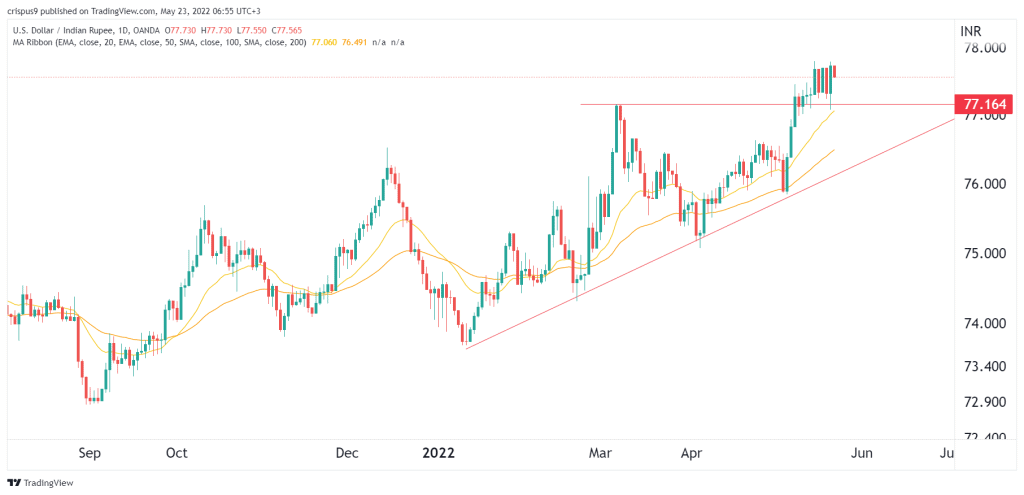

On the daily chart, we see that the USD/INR pair has been in a bullish trend lately. The pair managed to move above the important support level at 77.16, which was the highest level on March 7th. This price was above the upper side of the triangle pattern. It remains above the moving average ribbon.

Therefore, the long-term forecast is where the USD to INR pair keeps rising as bulls target the next key resistance at 78. A drop below the support at 77.16 will invalidate the bullish trend.