- The USD to INR pair is stuck at the 50-day EMA. Is it a good buy or does it have more room to slide in the coming days?

The USD/INR price retreated on Wednesday as demand for the US dollar and other safe havens remained tepid. As a result, the USD to INR exchange rate is trading at 75.84, about 1.70% below the highest level this month. The main reason is that the ongoing talks between Russia and Ukraine have led to optimism that the two sides will reach a deal in the coming weeks.

Why USD/INR is falling

The value of most safe havens have all declined this week. For example, the dollar index (DXY) has moved from a high of $99.9 to the current $97.98. Similarly, the price of crude oil has fallen to about $110, while gold is at $1,922. While these are elevated levels, they are significantly lower than where they were earlier this month. Similarly, stocks have jumped, with leading indices like the Dow Jones, Nasdaq 100, and Nifty 50 rising.

The USD to INR has also dropped as investors predict that the Federal Reserve will be cautious when hiking interest rates because of the bond market’s performance. On Monday, the yield curve inverted for the first time in years, signalling that a recession could be ahead. As such, whenever this happens, the Fed will likely move back to easy money policies.

Meanwhile, there are concerns that the Reserve Bank of India (RBI) is getting left behind by other central banks. Even as inflation rose to about 6%, the bank has continued with accommodative policies. There are risks that the bank will be forced to slam its brakes in a hurry as inflation keeps rising. In a note, an analyst at SBI Funds said:

“If you don’t normalize gradually and preemptively, you may be in a situation down the line where you have to slam on the brakes.” Other EM central banks like Brazil and South Africa have been battling the rising inflation by implementing several rate hikes.

USD to INR forecast

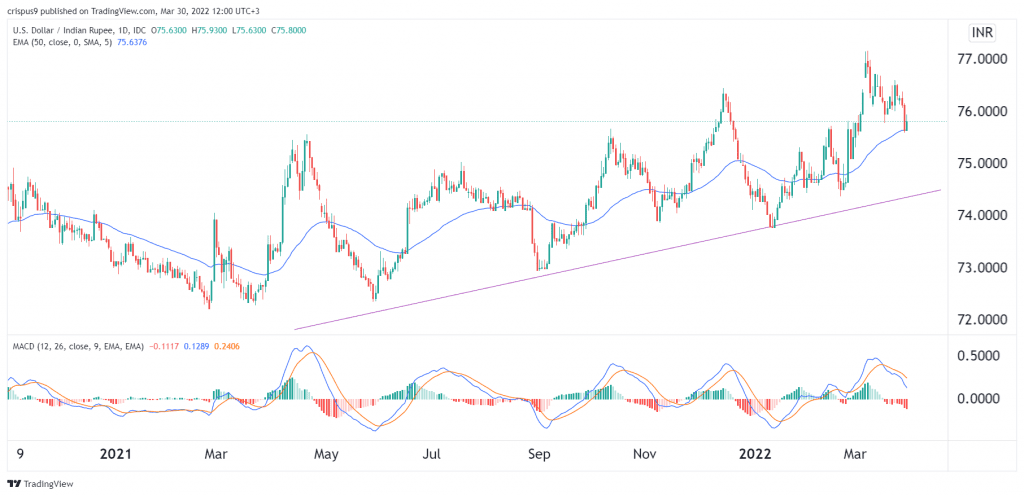

The USD/INR pair has been in a strong uptrend because of the dovish RBI. The pair has moved from a low of 72.20 in March 2021 to the current 75.80. Along the way, it has moved above the ascending trendline shown in purple and remained above the 50-day moving average for the most part. With the pair staying above this point for a while, it is likely to resume the bullish trend. A move below the 50-day MA will invalidate the bullish view.