- Summary:

- USD to INR forecast 2024 is bullish as strong crude oil prices and rising interest rates in the US send the dollar to multi-decade highs.

Table of Contents

Indian Rupee (INR) is on course to break its two-month losing streak against the US dollar in May, after going down by 0.54 percent in March and 0.14 percent in April. As of this writing, the rupee is up by 0.34 percent against the greenback, with the USDINR pair exchange rate at 83.15. This has largely been attributed to the return to investor inflows into Indian stock markets after a prolonged period of jitters caused by election worries. Furthermore, the US economy has been printing out soft data for the most part in May, reducing the dollar’s safe-haven appeal.

The USD/INR registered substantial gains in April, with a rally going on to reach an all-time high of 83.79 on April 17. The pair trades at 83.15 as of this writing, marginally above the 200-day SMA of 83.13, signaling a weak buying momentum. In June, the INR weekend majorly against the USD reaching a low of 85.19 INR per USD.

In July 2024, the Indian rupee showed signs of stabilising, with exchange rates around 83.63 due to the intervention by the Reserve Bank of India. However, in August, the rupee struggled to keep up, trading at 83.8 to 84 INR to USD. Global economic uncertainties, the continuous flow of capital from India, and the demand for the USD mainly caused this.

The constant interventions from the Reserve Bank of India supported the rupee for the first twelve weeks of 2024, keeping the rate below 83.50. However, the dollar’s resilience finally broke the resistance on March 22nd, and the USDINR pair went on to peak in mid-April. Also, Indian elections weighed in in April, resulting in a weaker rupee as local investors traded more cautiously and foreign institutional investors liquidated their positions.

RBI Interventions Limit Indian Rupee Losses Against the Dollar

USDINR was in a general downtrend on the daily chart between early December 2023 and Early March 2024, as the Indian rupee enjoyed a stellar run against the US dollar. Multiple interventions by the Reserve Bank of India (RBI) helped keep the rupee stable during a period when the dollar generally gained against major currencies. That said, the Fed’s monetary policy is expected to retain high-interest rates through the first half of 2024 as it pursues its target 2% inflation rate. This will continue exerting downward pressure against the rupee.

Since the start of the year, the US Federal Reserve and the Reserve Bank of India (RBI) have both remained hawkish. The Fed’s 5.25-5.50% interest rate is likely to carry into the second half of the year, as inflation remains stubbornly above the 2% target. On the other hand, in its April 2024 meeting, RBI maintained interest rates at 6.5%, helping provide support for the rupee.

Furthermore, India’s economy has been printing out strong growth figures, making a solid case for the RBI to retain the current rates for longer. Many analysts expect the RBI to keep the current rates through December 2024. On the other hand, the US GDP grew at a slower rate than expected in the first quarter of 2024, putting pressure on the Fed to consider cuts to mitigate adverse effects on the economy.

GDP figures and forex reserves

The Reserve Bank of India is expected to release the fourth quarter 2023 GDP figures on May 31, and that could inject fresh impetus into the USD/INR pair. Also, the bank will release its foreign reserves figures on the same day, and that could shed light on the RBI’s preparedness for intervention in the forex market.

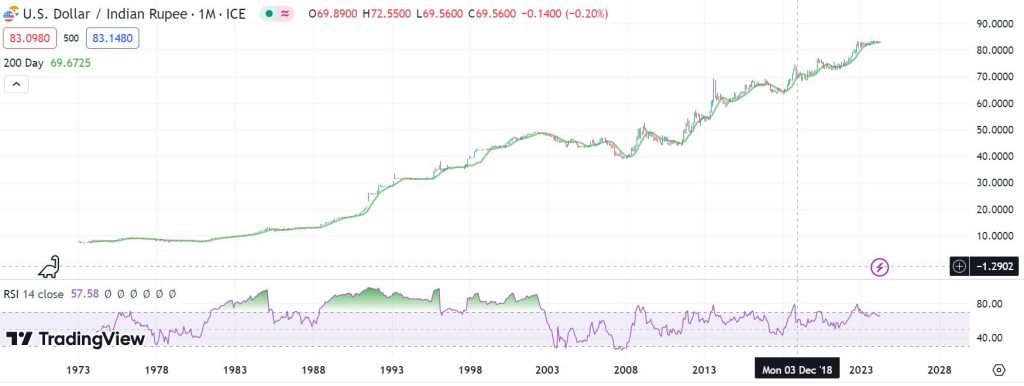

USD/INR Historical Chart

USD to INR trading dates back to 1973 when the pair was floated in the forex market at an opening price of $1 to 7.98 rupees. By late 1983, the currency pair rose past the psychological level of 10 rupees to the US Dollar. Between then and April 2002, it rallied by 376.41% to 48.76 rupees.

After retracing to 39.9 rupees in November 2007, the USD/INR has been on an uptrend since then. The pair surged to an all-time high of 83.47 on November 10th, 2023. Before attaining its all-time highs, the USD/INR tasted the 76.45 price mark in March 2020, just as the coronavirus pandemic was sweeping through the world.

As the US Federal Reserve started to hike rates, Indian rupee started to slide against the US Dollar. In October 2022, the pair surged to a new all-time high of 83.28. This ATH was refreshed in 2023. However, the dollar’s rally in 2024 saw it hit a new ATH on March 22.

USD/INR Outlook Amid Election Jitters

Indian elections will come to an end on June 1, after conducting a historic Lokh Sabha elections in which more than 970 million people were eligible to vote. The month-long voting exercise started on April 29th. However, it has also brought jitters as investors adopted a wait-and-see stance despite expectations that the ruling BJP will emerge victorious. One of the biggest concerns in recent weeks was the low voter turnout relative to previous elections. That raised the stakes for the BJP, with the likelihood that it could lose some control.

There was also a notable selloff in the Indian stock markets by foreign institutional investors, leading to elevated dollar demand since Mid-April. The trend has receeded in the last two weeks helping the rupee mount a recovery against the US dollar. Therefore, we are likely to see the USDINR decline in the near term, with marginal gains by the dollar.

Meanwhile, Indian inflation rates rose in April to 4.83%, higher than the forecast 4.80 %. This will likely see the Reserve Bank of India retain the current 6.5% interest rate for longer, providing further support to the rupee.

USD/INR Forecast 2024

As of this writing, USDINR is on the downward trajectory and is marginally above the 200-day SMA rate of 83.136. Furthermore, it hit a two-month low of 83.01 on May 21, testing a critical psychological support mark. Based on its performance in the second half of May, USD/INR looks susceptible to bearishness. Therefore, you might want to keep an eye on the 200-Day SMA at 83.136, which should serve as the pivot in the near term. A move below that level will signal control by the sellers by the pair. Furthermore, the 83.00 mark is the critical support for the year, and a breach of that level could signal bearishness.

Generally, the pair is likely to swing between 83.136 and 83.272. A break above the latter will signal control by the buyers, but the longest resistance is likely to be at 83.500.

US interest rate policy will play a crucial role in determining the USDINR exchange rate. If the first interest rate cut comes after June, then we are likely to see fewer cuts in 2024, translating to a stronger US dollar.

In the long term, oil prices will also play a key role in determining the trajectory of USD/INR. India, the world’s third-largest crude oil importer, has been importing cheap Russian oil amidst the Russsia-Ukraine war, reducing pressure on the rupee. Also, global oil prices declined significantly between April and May 2024, reducing the dollar demand in India. Therefore, the rupee could strengthen further if the trend continues.

What will be USD to INR Rate in 2025?

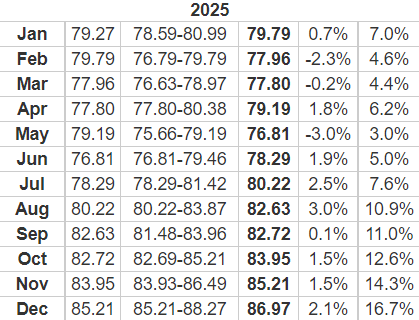

Long Forecast’s USD to INR forecast 2025 suggests the start of the year around 79.79 Rupees. It expects the currency pair to average 80 Rupees by mid-year before rallying further to 86.97 Rupees by the end of the year. The prices can go much higher if the global economy enters a prolonged recession after the ongoing deflationary measures.

It is important to note that the targets for September 2025 have already been met, while the price pattern on the daily chart indicates that there is a high potential for the October 2025 price target of 83.95 to be met in the second half of 2024. As it is, this makes the USD to INR forecast 2025 above quite viable, albeit with some minor differentials. It is crucial to conduct your own individual research.

USD to INR Forecast 2030

A feasible USD to INR forecast for 2030 is informed by the economic health of India and the US, Fed and RBI’s monetary policy, and the demand for the US dollar as a safe haven. Hence, a strong dollar will likely push USD to INR to a new record high, depending on the key drivers.

However, as an emerging market, India’s currency has the potential to strengthen further in the coming years. From that perspective, USD to INR forecast 2030 will be for the pair to remain within a range for several years.

How to trade USDINR

To trade USDINR, one needs to open an account with a reputable forex broker. When researching the best broker, it is helpful to consider their spreads, commissions, and other fees. It is also possible to trade the currency’s derivatives in the form of USDINR futures.