- Summary:

- The USD/SGD pair has a chance for a further advance if the bulls take out the 1.4000 resistance level, targeting 1.42.

The USD/SGD pair is up 0.03% this Tuesday amid low volumes as the pair tries to secure an advance beyond the 1.4000 psychological resistance level. The pair saw a growth burst on Friday following Fed Chair Jerome Powell’s hawkish remarks at the Jackson-Hole Symposium. Monday’s 0.1% uptick followed the 0.43% growth seen on Friday, notwithstanding the intraday rejection at the immediate resistance.

The USD/SGD tends to trade in a tight band as Singapore operates a managed float system for the Singaporean Dollar. With inflation hitting all-time highs, the Monetary Authority of Singapore (MAS) has said it would take steps to boost the value of the SGD. It plans to reset the midpoint of the nominal exchange rate policy between the Singaporean Dollar and a host of currencies that include the US Dollar.

However, recent data out of the US that has followed last Friday’s hawkish remarks by the Fed Chair could put this policy under strain due to the added strength of the greenback. The USD/SGD will also have to contend with Friday’s jobs data, which is expected to provide some direction for the pair before the big rate decision on 25 September.

USD/SGD Forecast

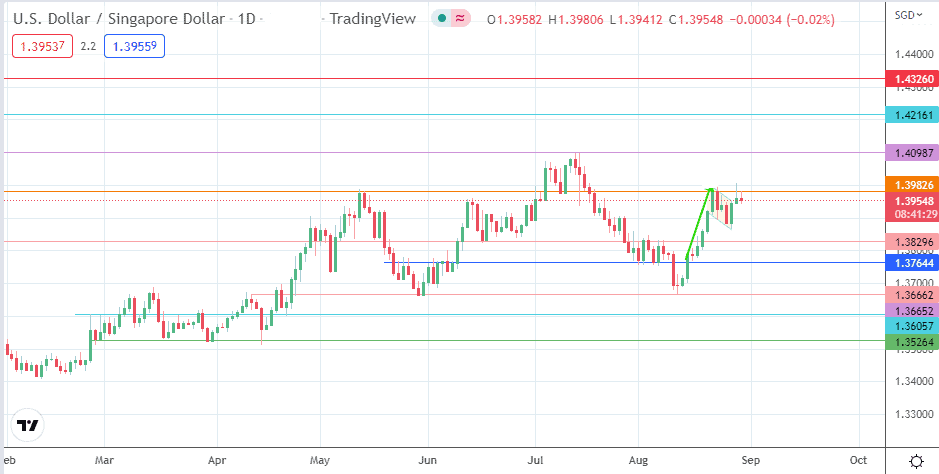

The break of the bullish flag by the 29 August candle confirms the validity of the pattern. However, the 1.39826 resistance formed by the prior highs of 13 May and 4 July 2022 is the immediate stumbling block that the bulls must overcome to push the measured move toward its completion point at 1.42161 (30 March low and 29 May 2022 high).

Clearance of 1.39826 must be followed by a break of 1.40987 (13 July high) for this to happen. The 21 April 2020 high at 1.43260 will become an additional target to the north if the advance continues.

On the flip side, the rejection at 1.39826 may allow for a downside push if the pinbar candles are considered. These candles need a bearish outside day confirmation that targets 1.38296 (3 May and 16 June lows) to make this outlook a reality. 1.37644 (8 June high/2 August low) will become a reality for the bears if they can degrade the 1.38296 pivot. The low of the 11 August doji candle becomes an additional southbound target if there is additional price deterioration. This move would also bring 1.36057 and 1.35264 into the mix as additional downside targets.

USD/SGD: Daily Chart