- Summary:

- The USD/SEK looks set to continue the uptrend move as the FOMC minutes supports more tightening by the Federal Reserve

The USD/SEK is up 0.43% this Thursday, as the Swedish Krona continues to fulfil the expectations of the institutional analysts of further weakness in the months ahead. The US Dollar is also gaining traction from the FOMC minutes that saw the Fed leaving the door open for more aggressive hiking action, even if opting for a data-driven approach.

Institutional analysts at several investment banks have been bearish on the Swedish Krona. Commerzbank’s economists have indicated that any further hawkish action by the Riksbank has largely been priced in, leading to exhaustion on the upside of the Krona.

Danske Bank is also of a similar view. It expects rising global recessionary risks and a cloudier growth outlook for Sweden to weigh on the Krona in the next 6-12 months, despite the potential for a 75 bps rate hike by the Riksbank in September.

Any rate hikes by both central banks on the divide will promote a continued existence of a rate differential between the Federal Reserve and the Riksbank. Given the other added fundamentals, this is expected to be bullish for the USD/SEK.

USD/SEK Forecast

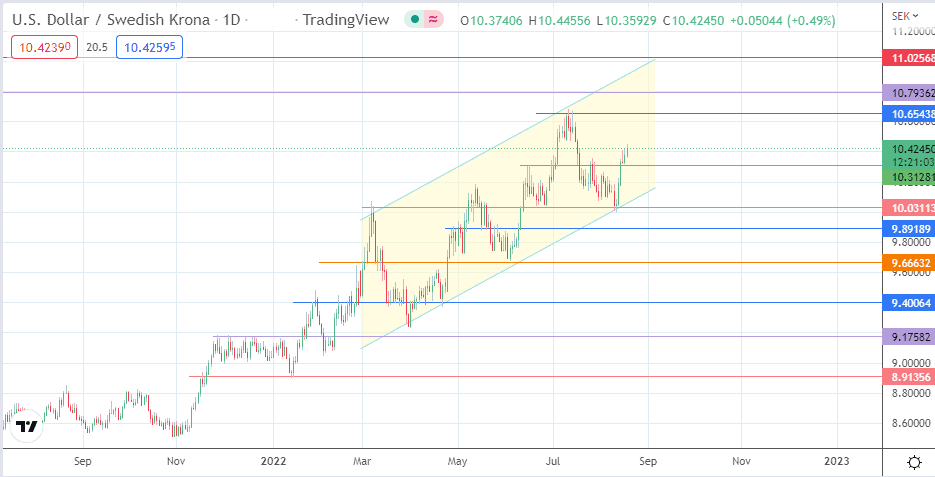

The break of the 10.31281 resistance level (15 June high, 16 August low) has given the bulls clear skies to aim for the 10.65438 resistance barrier, formed by the 12 July and 15 July 2022 highs. A clearance of this barrier in continuation of the uptrend brings the bulls to the 10.79362 multi-year resistance, last seen in May 2001.

Above this level, the July 2001 high forms the next resistance at 11.02568. This price barrier is the only obstacle between the bulls and new all-time highs. On the flip side, the bears need to force a breakdown of the 10.03113 support level (27 June and 10 August lows). This will open the door for the bears to gain access to the 9.89189 support (10 June low).

A further decline brings 9.66632 into the mix, being the site of the 9 March and 3 June lows. Additional support is seen at 9.40064 (16 March and 21 April lows) and at 9.17582, where the price action between 26 November 2021 and 19 January 2022 was unable to break above.

USD/SEK: Daily Chart