- The USD/RUB pair has entered into a period of consolidation ahead of Russia's producer price index data and the FOMC minutes.

The USD/RUB has entered into a period of consolidation, following a mild recovery in the pair from its recent late June and mid-July 2022 lows. The uptick resulted from strong US fundamentals and falling crude oil prices due to the raising of production outputs by the OPEC + alliance.

With the Russia-Ukraine war continuing to drag on with nothing but an escalation being forecast by military experts, the sharp strengthening of the Ruble seen in May 2022 may have ended, according to Eurasian Development Bank’s Chief Economist Evgeny Vinokurov. In the bank’s macroeconomic outlook for the month, the Ruble is seen stabilizing to levels which will be more comfortable for the budget and exporters, with import demand recovery being the primary driver of the intensity of price moves.

At its last policy meeting, the Russian Central Bank cut Russian interest rates sharply as the Ruble appreciated due to the adaptation of the economy to the sanctions regime and a lack of follow-through action on the threats of curbing energy product imports from Russia by the European Union.

On the fundamental bucket, Russia’s producer price index data will hit the newswires on Wednesday. The FOMC minutes are also due for release on the same day, providing the potential for a trade if the fundamentals are divergent.

USD/RUB Forecast

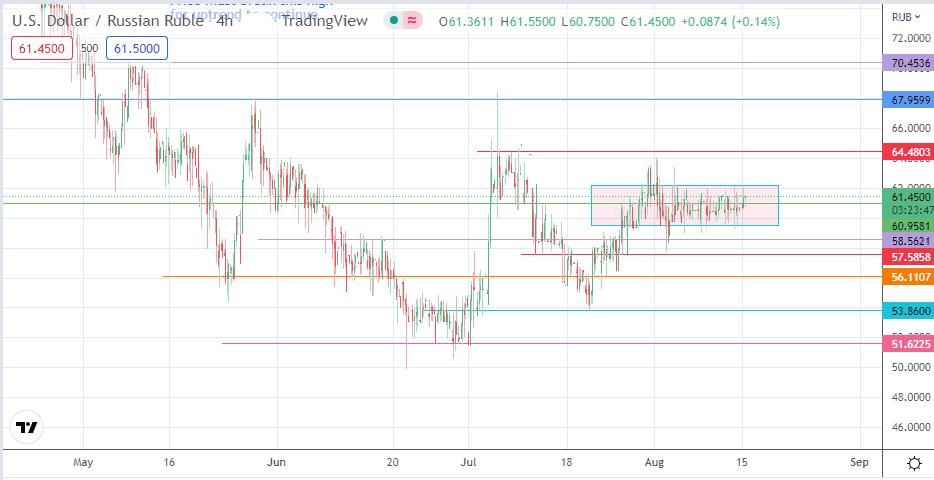

The price action has entered a consolidation pattern, as shown in the 4-hour Chart. The recovery move of the USD/RUB has to follow a break of the rectangle’s upper border at 62.1750. This break will target 64.4803 as the primary destination (8 July 2022 high).

A break of this resistance opens the door for the bulls to aim for 67.9599. The 66.0000 psychological price mark and site of the 13 May 2022 high may serve as an intervening barrier. The 9 May high at 70.4536 completes the near-term upside targets for the USD/RUB’s bulls.

However, a breakdown of the rectangle’s floor at 59.4605 clears the way for a descent toward 58.5621. Below this level, 57.5858 (12 July and 27 July lows) forms an additional downside target. In addition, there are other pivots which could serve as harvest points for the bears. These are found at 56.1107 (25 May low) and 53.8600, the 20 July 2022 low.

USD/RUB: 4-hour Chart