- Summary:

- The USD/MXN has soared for a 4th day in a row after risk aversion takes a toll on emerging market currencies.

The USD/MXN pair has soared this Wednesday by 0.9% after traders favoured the safe-haven US Dollar over the risk-associated Mexican Peso. Apart from being a commodity-linked currency, the Mexican Peso is also an emerging market asset. There has been a global liquidity turn away from emerging-market assets. Concerns that interest rate hikes could produce a global recession made the US Dollar the clear favourite in this week’s trading.

The Peso, which is linked to crude oil, has seen a massive slide versus the greenback this week after crude oil prices fell heavily. An oil workers’ strike in Norway that threatened North Sea production has also been called off, easing supply concerns and allowing Brent crude to fall further this Wednesday after Tuesday’s heavy slump.

A new outbreak of COVID-19 in Shanghai has also renewed fears of weaker demand. Authorities are carrying out mass testing and have implemented restrictions in some areas, calling into question hopes of demand recovery in the world’s second-largest crude oil importer. The USD/MXN is set for a 4th straight winning session and a sixth day of gains in seven.

USD/MXN Forecast

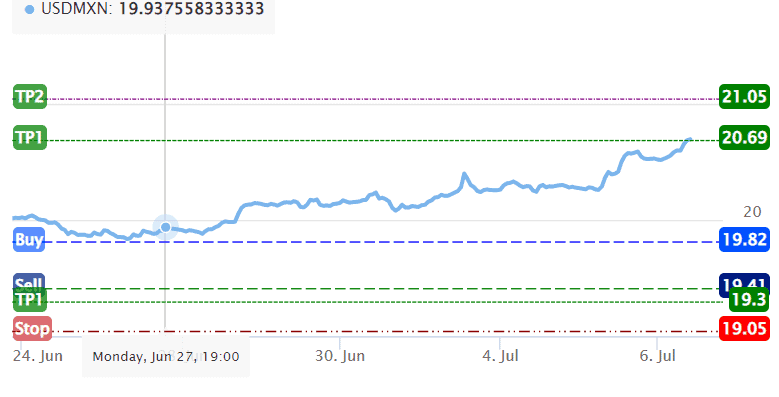

The Investingcube S-R indicator has set two profit targets to capture initial profits from the entry just above 19.82 and also to take advantage of a potential breakout of the price action above the immediate resistance at 20.6961 (15 June high).

A break of this resistance sends the pair toward the 21.06422 resistance (10 March high). The TP2 target lies just below this point. Additional barriers to the north are seen at the 21.30462 price mark (6 December 2021 high). However, 20.91331 (28 January 2022 high) comes into the picture as a potential pitstop before the TP 2 target.

On the other hand, a failed break of 20.69617 allows for a correction on the pair. Potential targets along the path of this retracement are at 20.48769 (25 April 2022 high), and the neckline of the 4 April, 14 April, and 19 April triple bottom at 20.19249. The 20.0000 price mark also comes into the mix as an additional target to the south.

USD/MXN Chart