- Summary:

- The USD/JPY price made a strong bearish move on Wednesday after the US published a relatively weak inflation report.

The USD/JPY price made a strong bearish move on Wednesday after the US published a relatively weak inflation report. It tumbled to a low of 132.05, which was the lowest point since August 2nd of this year. This price was still about 4.52% below the highest point this year.

Implications of the US inflation data

The USD to JPY exchange rate came under intense selling pressure after the US published the latest inflation data. Numbers by the Bureau of Labor Statistics (BLS) showed that the country’s consumer price index (CPI) dropped in July as the cost of gasoline pulled back slightly. After peaking at $5 per gallon in June, the price dropped to about $4.03 in July.

As a result, the headline CPI declined from 9.1% in June to 8.5% in July. Economists were expecting that the country’s inflation would drop to 8.7%. Core inflation, which excludes the volatile food and energy prices remained unchanged at 5.9%. Analysts were expecting the figure to rise to 6.1%.

Therefore, the USD/JPY price dropped as investors anticipated that the Fed will not be as aggressive as they have been in the past few months. They hiked interest rates by 0.75% in July, bringing the total year-to-date increase to 225 basis points.

Meanwhile, investors have recently slashed their yen short trades due to profit-taking. In a note, an analyst at BMO Capital Markets said: “Short yen was one of the biggest G10 FX positions held by leveraged funds and vulnerable to a squeeze. Last week that squeeze arrived.”

USD/JPY forecast

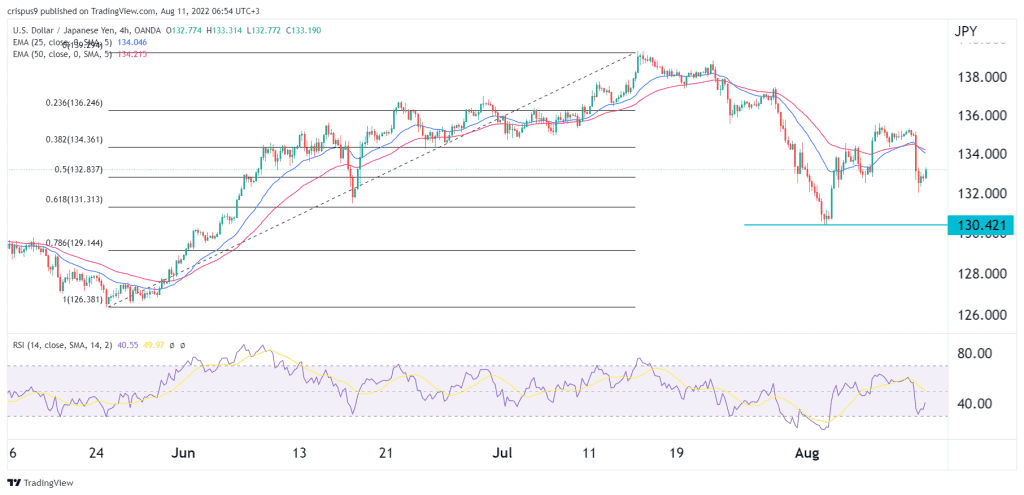

The four-hour chart shows that the USD to yen exchange rate peaked at about 139.43 in July this year. It then started a strong decline that saw it reach a low of 130.40, which was the lowest point since June of this year. The pair has moved below the 25-day and 50-day moving averages and is slightly above the 50% Fibonacci Retracement level.

The Relative Strength Index (RSI) has moved slightly above the oversold level. Therefore, the USD/JPY price will likely resume the bearish trend as sellers target the important support at 130.42. A move above the resistance at 13440 will invalidate the bearish view.