- Summary:

- The USD/JPY price moved sideways on Wednesday morning after the relatively mixed economic data from Japan.

The USD/JPY price moved sideways on Wednesday morning after the relatively mixed economic data from Japan. The USD to JPY exchange rate was trading at 134, which was about 2.90% below the lowest level in August of this year. This price is also about 3.7% below the highest level this year. Focus now shifts to the upcoming US retail sales and FOMC minutes.

Japan’s trade deficit widens

The USD/JPY price moved sideways after the latest data by Japan’s statistics agency. The data revealed that the country’s exports rose by 19% on a year-on-year basis in July. That increase was better than the median estimate of 18.2%. Imports, on the other hand, rose from 46.1% in June to 47.2% in July. Again, this was better than the estimated 45.7%. As a result, the country’s trade deficit continued to rise.

Additional data showed that Japan’s machinery orders rose at a slower pace in June of this year. Orders rose by 0.9%, which was lower than the expected 1.3%. This translated to a year-on-year increase of 6.5%. Again, this was a smaller increase than expected.

The USD/JPY price will next react to the latest economic data from the United States. The country’s statistics agency will publish the latest retail sales numbers. Economists polled by Reuters expect the data to show that the country’s sales rose by 0.1% in July after rising by 1% in the previous month. Core sales, which exclude the volatile food and energy products, are expected to drop by 0.1%.

These numbers will come a day after the US published weak housing starts and building permits data. The next key catalyst for the USD to JPY exchange rate will be the upcoming minutes by the Federal Reserve. These minutes will provide more color about the next actions by the Fed.

USD/JPY forecast

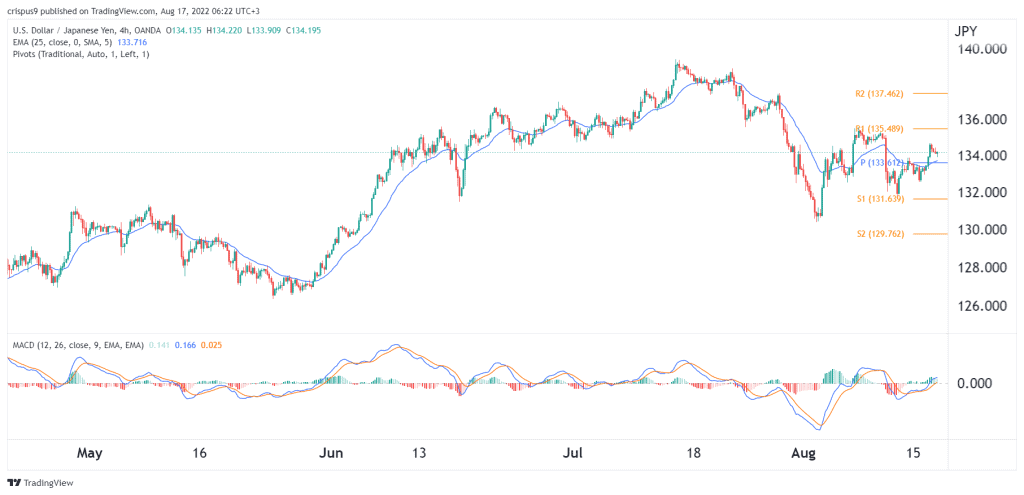

The four-hour chart shows that the USD to yen price rose to 134 after the mixed data from Japan. This price was slightly above the 25-day and 50-day moving averages while the MACD has moved above the neutral point. It was also slightly above the standard pivot point.

Therefore, the pair will likely remain in this range ahead of the FOMC minutes. It will then break out to the first resistance of the pivot point at 135.50. A move below the pivot point will invalidate the bullish view.