- Summary:

- The USD/JPY pair has moved sideways recently as investors focus on the widening divergence between the Federal Reserve and the Bank of Japan

The USD/JPY pair has moved sideways recently as investors focus on the widening divergence between the Federal Reserve and the Bank of Japan (BOJ). The pair is trading at 113.55 as the market waits for the upcoming US consumer inflation data.

The US will publish the latest consumer price index (CPI) data on Friday. Economists expect these numbers to show that the country’s inflation rose from 6.2% in October to 6.7% in November. This will be the highest level in decades. Core CPI, which excludes the volatile food and energy prices, is expected to have risen by about 5%.

These numbers will have an important impact on the USD/JPY considering that the Federal Reserve and the Bank of Japan will hold their last meeting of the year next week.

Analysts expect that the Fed will increase the size of its tapering while the BOJ will sound a bit cautious. Besides, Japan is going through a period of low inflation and slow economic growth. Japan’s PPI rose by 9% in November, meaning that companies are not transferring costs to consumers.

USD/JPY forecast

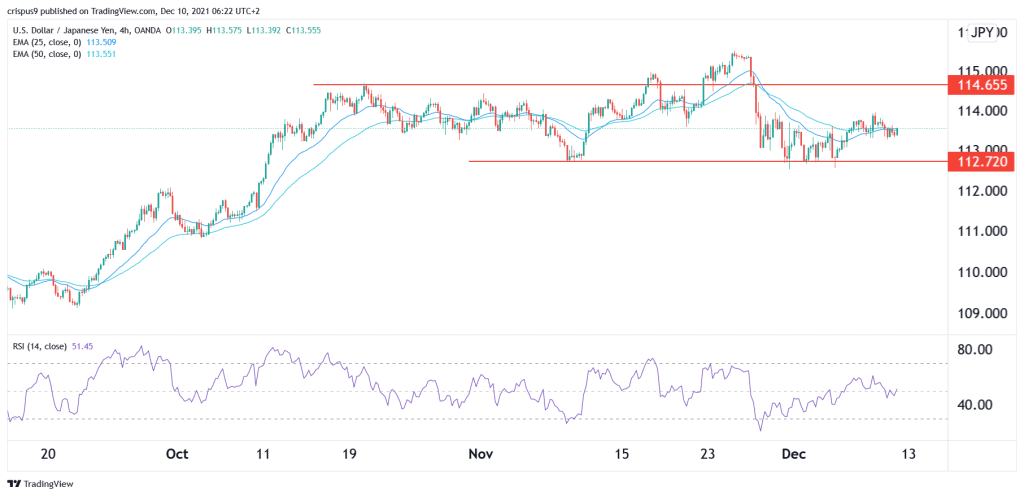

The four-hour chart shows that the USD/JPY pair has moved sideways recently as traders wait for the latest US inflation data. The pair is trading at 113.52, where it has been in the past few days. It is also along the 25-day and 50-day moving averages while the Relative Strength Index (RSI) is at the neutral level and pointing downwards.

Therefore, the outlook of the USDJPY is neutral with a bullish bias ahead of the US CPI data. This could see the pair move above the key resistance at 114. The pair will likely remain in this range as focus shifts to the Fed and BOJ decisions.