- The USD/JPY price has crawled back in the past few days qs investors wait for the upcoming interest rate decision by the Federal Reserve

The USD/JPY price has crawled back in the past few days as investors wait for the upcoming interest rate decision by the Federal Reserve. The pair rose to a high of 137, which is slightly above last week’s low of 135.57. However, this price is about 1.85% below the highest point this year.

Fed and BoJ divergence

The USD/JPY price has been in a strong bullish trend in the past few weeks as investors focus on the rising divergence between the Fed and the Bank of Japan (BOJ). This divergence has created a perfect carry trade opportunity by widening the spread between American and Japanese bond yields.

Last week, the BOJ maintained its dovish tone in a bid to supercharge the economy. However, the bank also committed itself to more easing if the situation worsens. With rates already in the negative zone, the bank will likely ease by continuing its aggressive asset purchases.

On the other hand, the Fed has taken a different policy stance by ending its QE program and started quantitative tightening (QT). It has also moved to hike interest rates aggressively. The Fed will conclude its two-day meeting on Wednesday and likely hike rates by either 0.50% or 1%.

The USD/JPY price has risen sharply in the past few months and is close to its 24-year low, contributing to higher inflation. Still, analysts believe that the BOJ will stay put as long as the USD to JPY remains below 145.

USD/JPY forecast

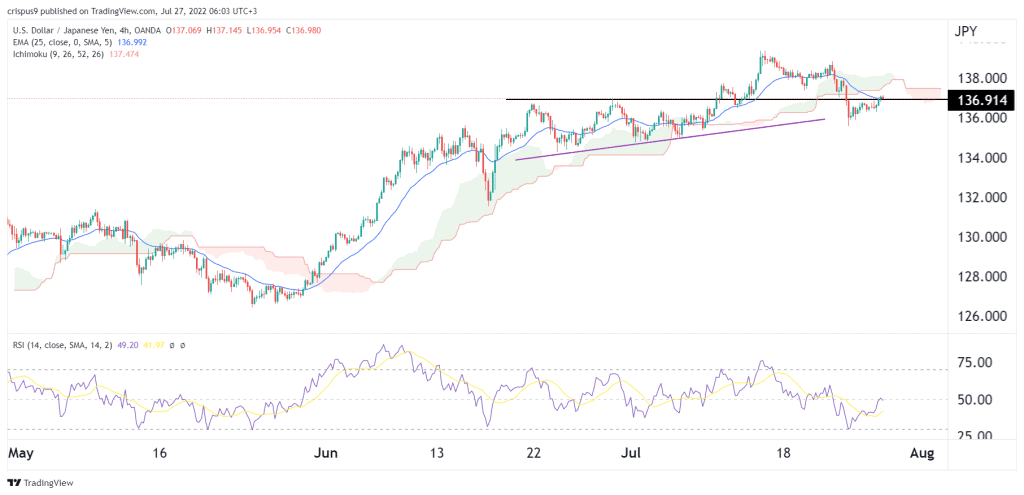

The daily chart shows that the USD to JPY exchange rate has been in a strong bullish trend in the past few months. After falling to a low of 135.65 last week, the pair has crawled back to the current 136.91. This is important since it was the highest point on June 13. It has also formed a small head and shoulders pattern.

Therefore, the pair will likely resume the bearish trend as sellers target the next key support level at 135.70. A move above the resistance at 137 will invalidate the bearish view.