- Summary:

- The USD/INR price moved sideways on Monday morning as investors refocused on the upcoming events from India and the United States

The USD/INR price moved sideways on Monday morning as investors refocused on the upcoming events in India and the United States. The pair rose to a high of 79.57, which was about1.82% above the lowest level this month. This price is slightly below the year-to-date high of about 80.21.

India trade and US FOMC minutes

The USD to INR exchange rate remained in a tight range as investors waited for the upcoming events in the United States. However, the main catalyst for the pair will be the upcoming minutes by the Federal Reserve that will come out on Wednesday. These minutes will provide more details about the deliberations in last month’s Fed meeting.

Recently, most Fed officials have hinted that they will continue hiking interest rates in the coming months even as inflation eased slightly. Data published last week showed that American inflation dropped from 9.1% to 8.7% in July of this year. The producer price index also pulled back slightly.

The USD/INR will also react to the latest American retail sales data that will come out on Wednesday. Other important numbers to watch will be the latest US housing starts, building permits, and industrial production.

Elsewhere, the USD to INR exchange rate will react to the upcoming data from India. India will deliver the latest food price index on Tuesday followed by the latest imports and exports data on the following day.

USD/INR forecast

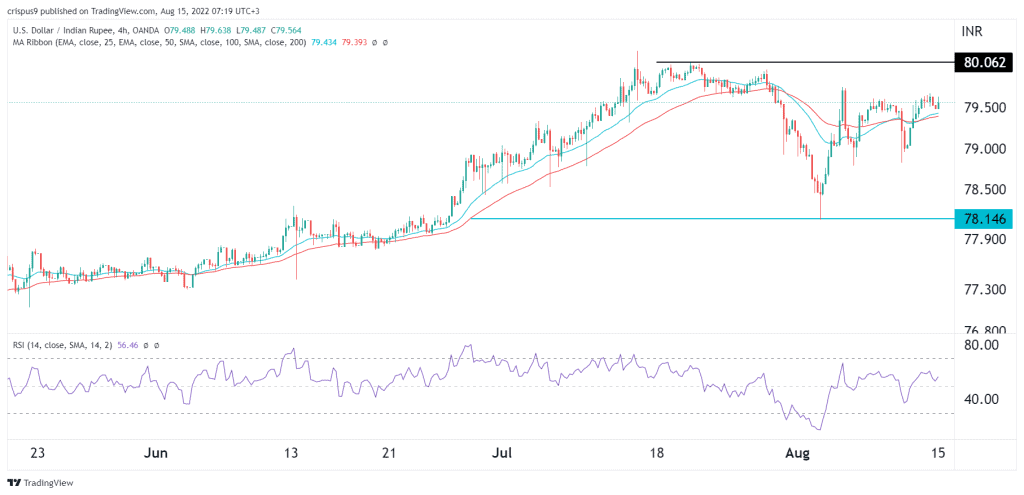

The four-hour chart shows that the USD to rupee rate has been in a tight range in the past few days. In this period, the pair has struggled to move above the important resistance point at 79.65. On the other hand, it has moved slightly above the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has moved slightly above 50.

Therefore, the pair will likely continue rising as bulls target the next key resistance point at 80. A drop below the support at 79.34 will invalidate the bullish view. This view is in line with my previous USD/INR forecast.