- Summary:

- What is the outlook of the USD/INR? We explain what to expect now that the USD to INR has jumped to an all-time high.

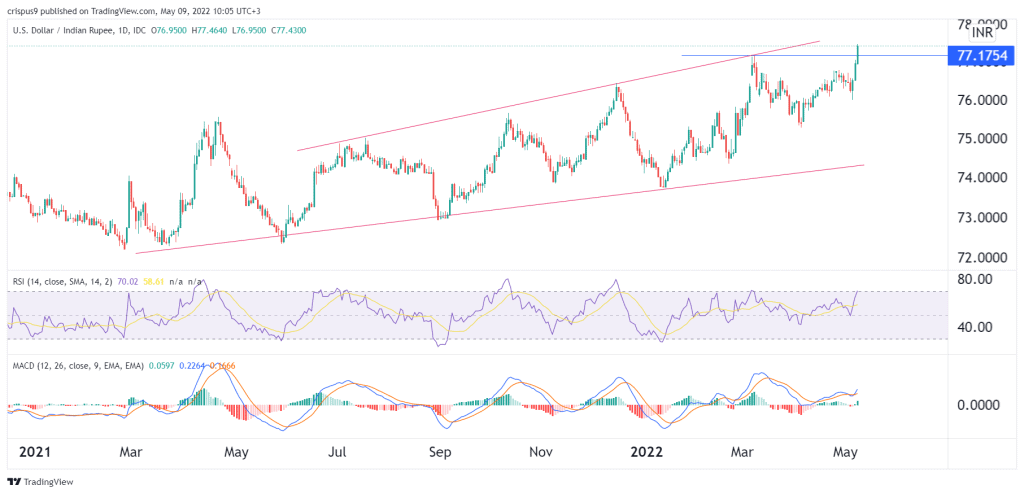

The USD/INR pair soared to an all-time high of 77.46 as the strength of the US dollar continued. The USD to INR price is trading at 77.41, about 4.95% above its lowest level this year. It has risen by over 20% in the past five years, making the Indian Rupee one of the worst-performing emerging market currencies in the world.

The USDINR pair has been in a strong bullish trend in the past few months as the divergence between the Federal Reserve and the Reserve Bank of India (RBI) continues. Last week, the RBA surprised the market when it decided to hike the interest rate for the first time in more than two years. However, the situation happened begrudgingly as the country continued to face significant inflation risks.

The USD/INR price rally is mostly because of the hawkish Federal Reserve. The Fed decided to hike interest rates by 0.50% and hinted that it would increase rates in the remaining five meetings. In addition, the officials announced that it would start implementing quantitative tightening policies.

With no economic data from India expected, the key catalyst for the USDINR will be the upcoming inflation data from the United States. Economists expect that the headline consumer price index (CPI) declined from 8.5% to 8.1% in April. Similarly, the core CPI is expected to have declined from 6.5% to 6.0%. If these estimates are correct, there is a likelihood that the USD will retreat since it will signal that inflation is peaking.

USD to INR price outlook

On the 1D chart, we see that the USDINR pair has been in a strong bullish trend in the past few months. In this period, the pair has jumped to an all-time high. A closer look shows that it has formed an ascending channel pattern that is shown in red. At the same time, oscillators show that the pair has moved to the extreme overbought level.

The uptrend is also being supported by the short and long-term moving averages. Therefore, while the overall trend is bullish, there is a likelihood that the rally will take a breather after the latest US inflation data. If this happens, the next key support level to watch will be at 76. A move above 80 will invalidate the bearish view.