- The USD/INR price is hovering near its all-time high as investors price in higher inflation and slow economic growth in India.

The USD/INR price is hovering near its all-time high as investors price in higher inflation and slow economic growth in India. The USD to INR has jumped even after the recent hawkish statements from the Reserve Bank of India (RBI). Therefore, there are increased concerns that the India rupee will retest the important level of 79 soon.

Indian rupee sell-off gains steam

The USD/INR price has been in a strong bullish trend in the past few months due to the strength of the US dollar. The dollar index has surged by almost 10% this year due to the extremely hawkish actions by the Federal Reserve. In its bid to fight the soaring inflation, the Fed has hiked interest rates by more than 150 basis points this year. And analysts expect that the bank will boost rates by another 75 basis points this month.

Meanwhile, the RBI has attempted to save the vulnerable rupee. Most recently, the bank decided to sell US dollars. By selling US dollars, the bank is aiming to boost demand for the Indian rupee in the market and stabilize it in the coming months. The RBI will publish the latest FX reserves this week. Analysts expect the data to show that US dollar reserves dropped in June.

Still, some analysts believe that RBI actions will have no major impact on boostig rupee. An analyst told Reuters: “There was sporadic intervention even today and that helped avoid a breach of 79 on the USD/INR in today’s session. But the RBI cannot prevent the depreciation which is in line with what is happening globally.”

USD to INR price prediction

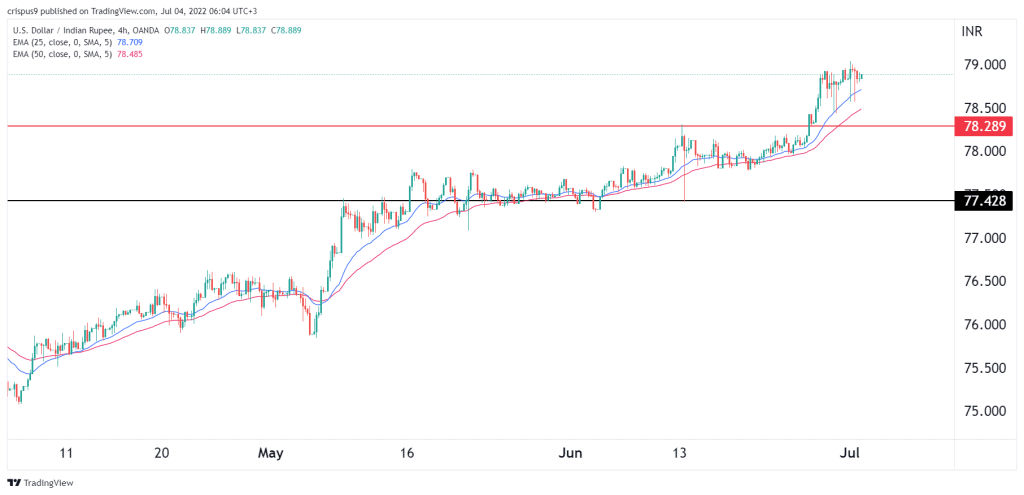

The four-hour chart shows that the USD/INR price has been in a strong bullish trend in the past few months. Last week, the pair rose to the important resistance at 79. It remains above the important support level at 78.28, which was the previous all-time high. It has also moved above the 25-day and 50-day moving averages.

Therefore, the USD to INR price will likely continue rising as bulls attempt to move above the key resistance level at 80. A move below the support at 78.28 will invalidate the bullish view.