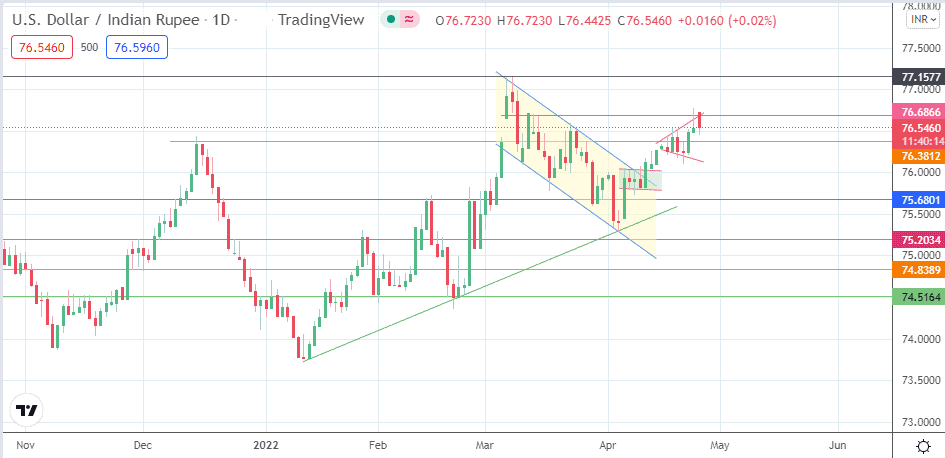

- The formation of the megaphone top on the daily chart points to a potential for correction on the USD/INR pair.

The USD/INR opened the day with an upside gap but quickly fell as the bears covered the gap. However, the pair remains 0.03% higher on the day after the bulls pushed back on the gap covering action.

This move comes a day after the bulls pushed price action towards the 76.6866 resistance but met opposition from the bears. The price action of the last few days reveals an evolving megaphone top pattern. This comes soon after the completion of the bullish flag pattern identified in the last USD/INR update.

Fundamentally speaking, the weakening of crude oil prices in the last few days appears to have taken some sting off the USD bulls, resulting in the inability to transcend the current resistance. However, the bets of more aggressive Fed action in tightening rates continue to be a tailwind propelling the pair.

The USD/INR’s price moves will continue to be an interplay between the sentiment around expected Fed action in the US and crude oil prices in response to the Russia-Ukraine war.

USD/INR Outlook

The 76.6866 resistance (15 March high) continues to serve as the immediate resistance to the pair’s uptrend, having rejected any more advances beyond this point on two consecutive days. The scenario also validates the expanding triangle pattern/megaphone top on the daily chart, following the conclusion of the measured move from the bullish flag.

The bears need to force prices below the 76.3812 support level to confirm the breakdown of the megaphone top, which opens the door towards 75.6801 (22 December 2021 high and 31 March 2022 low). The 76.000 psychological price mark may serve as a pitstop to the downward move. Additional price targets to the south include 75.2034 (6 December 2021 low) and 74.8389 (29 November/1 December 2021 lows).

On the other hand, the bulls need to force the price action above the 76.6866 resistance for the advance to continue. A 3% penetration close above this resistance confirms the breakout and opens the door for a push towards the recent all-time high at 77.1590. Only when this barrier is uncapped can the USD/INR push towards new record highs.

USD/INR: Daily Chart

Follow Eno on Twitter.