- Summary:

- The USD/INR is trading lower as cheaper oil prices benefit the Indian Rupee at the expense of the greenback.

The USD/INR pair is trading 0.77% lower this Monday as the Indian Rupee benefits from a weaker dollar occasioned by lower oil prices and a weaker-than-expected Non-Farm Payrolls report. Crude oil prices on the Brent benchmark had gone as high as $138 per barrel at the height of the Russia-Ukraine conflict. However, with peace talks offering hope for a truce, oil prices have cooled to $107 per barrel.

The situation has benefitted the Rupee at the expense of the US Dollar, as the world’s third-largest importer of crude oil continues to buy Russian oil at discounted prices. Hence, lower oil prices tend to strengthen the currencies of net oil importers.

The USD/INR had shot to record highs in mid-March after the Fed lifted the lid on its interest rate tightening cycle following 40-year consumer inflation in the US. Around the same time, the Reserve Bank of India (RBI) had kept its interest rates steady, creating a divergence in rate policy that allowed the greenback to gain massively over the Rupee. However, that fundamental metric has given way to geopolitical factors, with the Russia-Ukraine crisis dominating the space.

The majority of buyers of Russian oil have shunned the country, but India has stood resolute with Russia and has ramped up imports of Russian oil at discounted prices. However, the influence of this factor may wane soon after Global Times China quoted Russian Security Council Deputy Secretary Mikhail Popov as saying that the US had also increased its imports from Russia by 43% in the past week.

Furthermore, the downbeat Non-Farm Payrolls report did little to boost the USD’s value. As such, traders found the opportunity to take profits after several weeks of USD strengthening following the Fed’s rate lift-off.

USD/INR Outlook

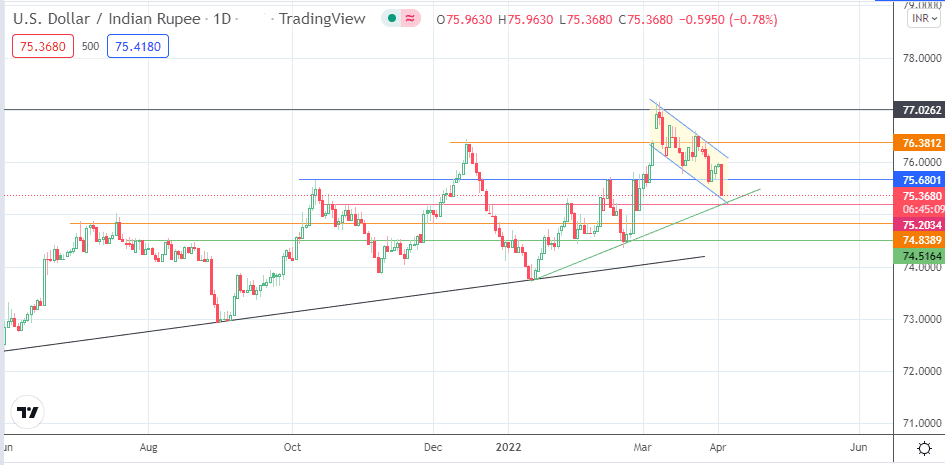

The 0.77% drop in the USD/INR rate is approaching the double support provided by the ascending trendline connecting the 12 January and 22 February lows and the 75.2034 support line. The descending channel’s return line offers another layer of support.

A breakdown of all support levels opens the door toward the 74.8389 price mark. The 74.5164 price mark lurks closely as an additional target to the south. On the flip side, a bounce on these support levels allows the USD/INR price activity to push towards 75.6801. The 76.3812 resistance level only comes into play when the channel’s trendline is broken.

USD/INR: Daily Chart

Follow Eno on Twitter.