- Summary:

- The USD/INR price remained under pressure on Monday as investors refocused on the upcoming American and Indian consumer inflation data

The USD/INR price remained under pressure on Monday as investors refocused on the upcoming American and Indian consumer inflation data. It dropped to a low of 79.65, which was slightly below last Friday’s high of 79.83. The pair has risen by almost 7% this year, meaning that the Indian rupee has outperformed other top emerging market currencies.

US and Indian inflation

The USD/INR price has been in a tight range in the past few weeks as the market continues to watch the divergence between the Federal Reserve and the Reserve Bank of India (RBI).

On the one hand, the Fed seems like it will continue hiking interest rates in the coming months. Analysts expect that the bank will hike by 75 basis points in November and 50 basis points in December. This case was made on Friday after the United States published strong jobs numbers as the unemployment rate dropped to 3.5%.

On the other hand, the Reserve Bank of India (RBI) will likely slow its rate hikes in the coming months since India’s inflation is not growing as fast as in other countries. The crisis in Ukraine has seen India continue buying Russian oil and gas at a strong discount.

The next key catalyst for the USD/INR price will be the upcoming inflation data from India and the United States. On Wednesday, data from India is expected to show that the country’s consumer price index (CPI) rose from 7.0% to 7.3%. In the United States, data is expected to show that core PPI rose to 7.3% while CPI rose by more than 7%.

USD/INR forecast

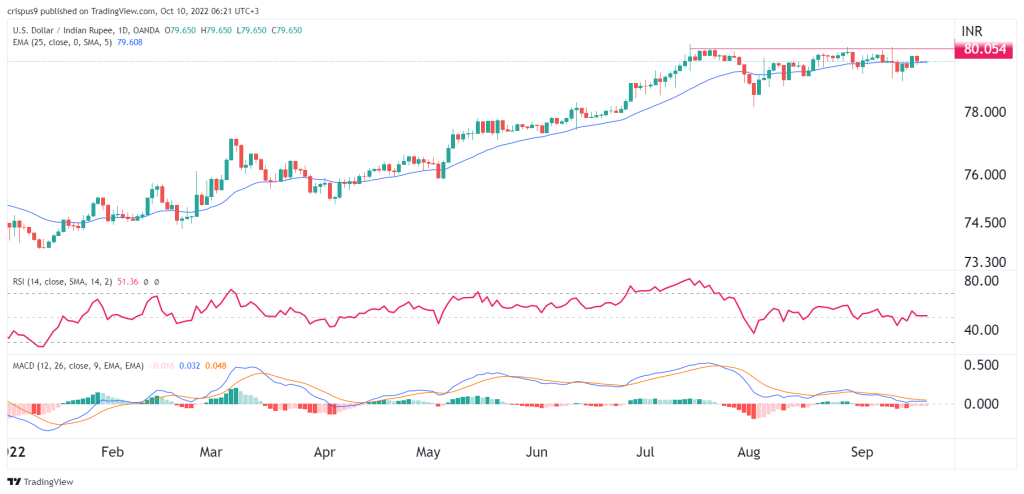

The chart shows that the USD to INR price has been in a tight range in the past few days. It has remained slightly below the important resistance level at 80, which was the highest level this year. It is also consolidating around the important 25-day and 50-day moving averages. The Relative Strength Index (RSI) and MACD were moving sideways.

Therefore, the USD/INR price will likely continue rising as bulls attempt to move above the important resistance at 81. A move below the support at 79.50 will invalidate the bearish view.