- Summary:

- The USD/INR exchange rate surged above 80 for the second time this year after the extremely hawkish statement by Jerome Powell

The USD/INR exchange rate surged above 80 for the second time this year after the extremely hawkish statement by Jerome Powell and other Fed officials. The USD to INR rate is trading at 79.95, which is about 2.32% above the lowest level this month.

King dollar bounces back

The Indian rupee joined other developed and emerging market currencies in crashing after the hawkish statement by Jerome Powell and other Fed officials at the Jackson Hole Symposium in Wyoming. In his speech, Powell reiterated that the bank will continue hiking interest rates in the coming months. Most importantly, he hinted that rates will stay at an elevated level for a while.

His statement was against what most analysts were expecting. Before the meeting, most analysts were expecting the Fed will start slowing down its rate hikes. Forward data pointed to a situation where the Fed will start cutting rates in 2023. Besides, recent data show that inflation has started falling. On Friday, the latest PCE data showed that prices pulled back slightly in July.

The USD/INR price rose because of a potential divergence between the Fed and the Reserve Bank of India (RBI). Analysts expect that the RBI will start slowing its rate hikes. They expect that it will only hike by just 0.25% in September. As such, the spread between US and Indian yields will continue growing.

USD/INR forecast

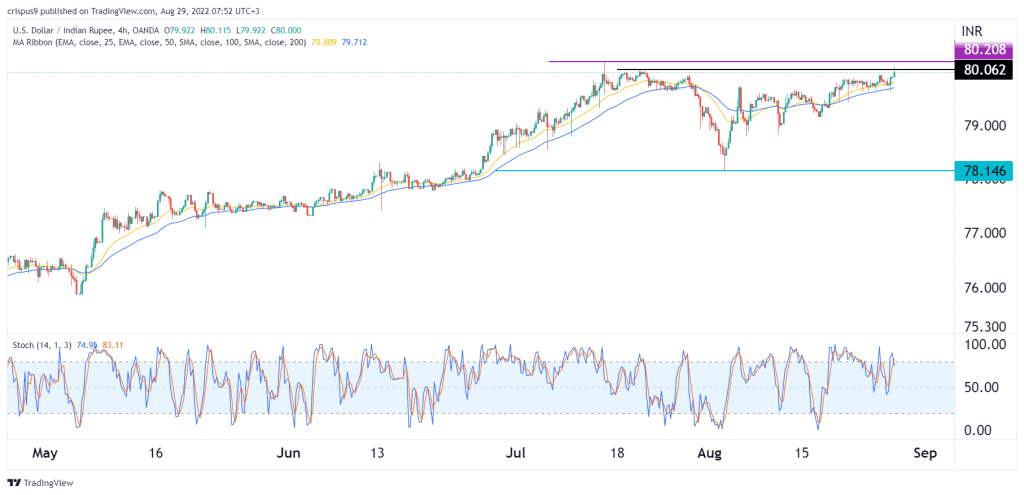

The four-hour chart shows that the USD to INR exchange rate has been in a strong bullish trend in the past few days. Along the way, the pair formed an inverted head and shoulders pattern and moved above the 25-day and 50-day moving averages. The Stochastic Oscillator has moved to the overbought level.

Therefore, the path of the least resistance for the USD/INR price is bullish as the dollar strength continues. If this happens, the next key resistance level to watch will be at the all-time high of 80.20 followed by the next psychological level at 81. A drop below the support at 79.50 will invalidate the bullish view.