- The USD/HKD price came under intense volatility after Hong Kong reduced its quarantine days and after the US inflation data.

The USD/HKD price came under intense volatility after Hong Kong reduced its quarantine days and after the US published the latest consumer inflation data. The pair was also reacting to the rising tensions between the US and China on Taiwan. It dropped to a low of 7.844, which was sharply lower than the upper side of the peg.

Will the Hong Kong dollar peg remain?

The USD/HKD exchange rate dropped sharply after the US delivered cooler-than-expected consumer price index (CPI) data on Wednesday. The numbers showed that the country’s consumer inflation dropped sharply in July as the price of gas dropped. After peaking at around $5 in June, gasoline prices averaged about $4 in July. As a result, this led to inflation falling from 9.1% in June to about 8.8% in July.

Therefore, the USD to HKD exchange rate dropped as investors focused on the next actions by the Federal Reserve. Some analysts believe that Fed officials will start slowing the pace of rate hikes in the coming months. However, some Fed members believe that higher rates are necessary until inflation continues falling to the target at 2.0%.

According to Neel Kashkari and Charles Evans, higher rates were still necessary. Kashkari, an often dovish member, said that he hopes that rates will rise to 3.9% by end of the year and to 4.3% by end of 2023. He said:

“I think a much more likely scenario is we will raise rates to some point and then we will sit there until we get convinced that inflation is well on its way back down to 2% before I would think about easing back on interest rates.”

USD/HKD forecast

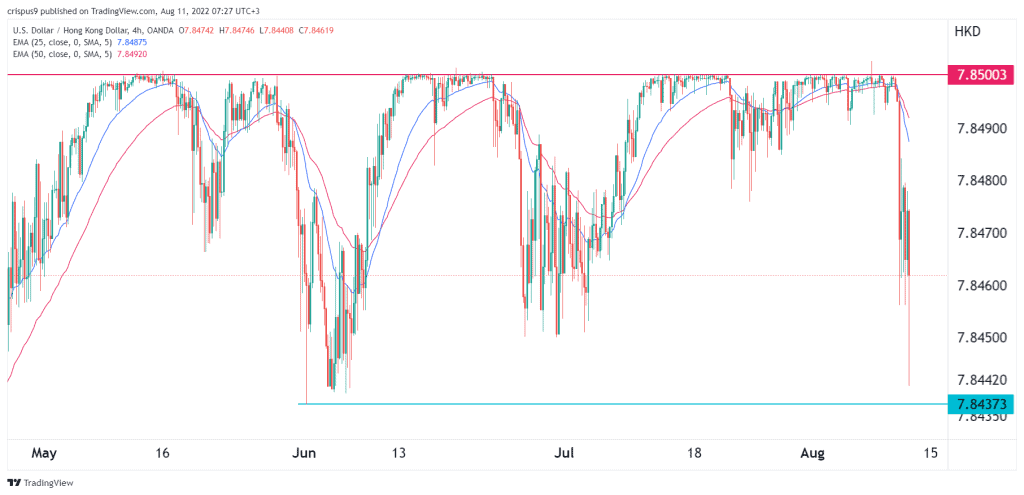

The USD/HKD is unlike other pairs because it trades at a well-defined range of between 7.75 and 7.85. Hong Kong’s authorities always intervenes whenever it moves below or above the peg. Recently, the Hong Kong Monetary Authority has drained cash from the financial system to help the currency recover.

The pair dropped to a low of 7.8440, which was the lowest level on June 6th. It has managed to move below all moving averages. Therefore, with the momentum being bearish, there is a likelihood that the pair will continue falling as sellers target the support at 7.8437. A move above the resistance at 7.84 will invalidate the bearish view.