- Summary:

- Disappoinment for the USD as NFP numbers disappoint. All eyes now on US Fed Chief Jerome Powell as he speaks in Zurich today.

The USDJPY pair hit session lows of 106.66 in the NY session after disappointing NFP results overshadowed growth in average hourly earnings. However, the response has been relatively muted, as there is a lack of strong follow-through selling.

- The drop in number of hirings as well as increase in hourly earnings is being attributed to a number of reasons:

- Companies that are being hit by the US-China trade impasse are not hiring as much, with other firms also hiring cautiously as well die to the uncertainties around the current trade situation.

- Companies that are still hiring are finding it hard to get workers with the right skills set.

Fed Chair Jerome Powell is scheduled to give a speech today at 4.30pm GMT on “Economic Outlook and Monetary Policy”, at an event in Zurich. Audience questions may be asked after the speech, and responses by the Fed Chair will be closely watched. No doubt, today’s NFP results will bring into focus once more, the situation with interest rates in the US. US Presiden Donald Trumphas never held back on his beliefs that US companies would have been at a better place with more aggressive easing from the Fed. No doubt, the poor jobs numbers for August will provide further ammo for Trump to press Powell for a robust easing cycle.

As analysts increasingly price in two 25bp rate cuts for September and December respectively, comments by Powell at today’s event will be closely monitored for clues.

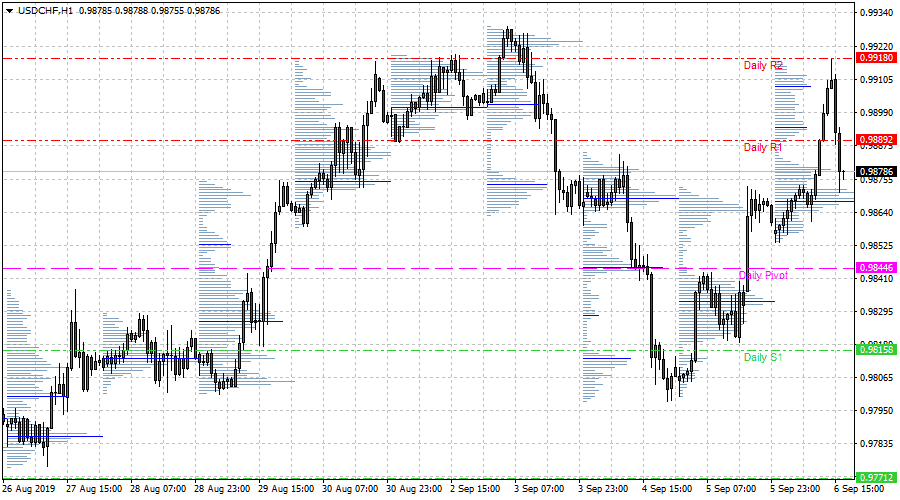

Traders who are already in active positions on the USDJPY and USDCHF pairs must carefully evaluate their positions as the comments by the Fed Chief hit the newswires.