- Here is the USD/CNY outlook amid an evolving geopolitical situation between China and Taiwan, with the US at the centre of it all.

From a position of a lack of clarity on her travel itinerary, US House Speaker Nancy Pelosi eventually made the trip to Taiwan, becoming the first top-ranking US government official to travel there in several years. The move was not lost on Beijing, which does not recognize Taiwan as a sovereign state and has promised retaliations for what it calls “a highly provocative and dangerous act.” China’s initial response has been to deploy heavy military equipment around Taiwan as it conducts military drills.

Weak factory data undermined the Yuan earlier in the week, with July’s Chinese Purchasing Managers Index falling from 50.2 to 49.0 (consensus of 50.4). However, the Yuan has since staged a mild recovery against the greenback. The losses in the USD/CNY appear capped and relatively minimal, as the greenback is seeing support this Wednesday from hawkish Fedspeak and rising bond yields.

The US ISM Services PMI data is due later today. This is not expected to exert much of an impact on the USD/CNY as geopolitical factors will dominate.

USD/CNY Forecast

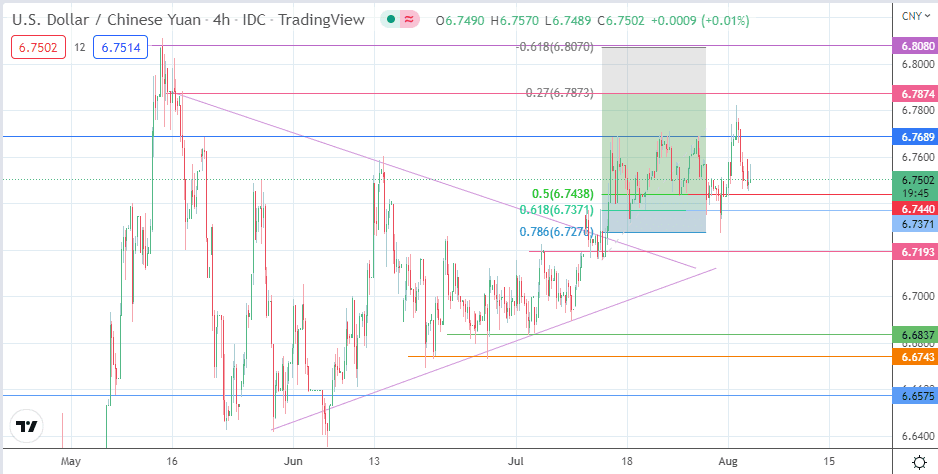

The breakout move from the symmetrical triangle has evolved into a consolidation. This range has the 50% Fibonacci retracement of the 13 July to 27 July price swing at 6.7440 serving as the floor, while 6.7689 serves as the ceiling despite the failed violation of 1 August 2022. The bounce from the range’s floor sets up a potential move toward the 6.7689 ceiling (22/27 July highs).

A break above this level continues the breakout move as it seeks completion at the 6.8080 resistance (13 May high and 61.8% Fibonacci extension mark). To attain this completion point, the bulls must take out the 17 May high and 27% Fibonacci extension level at 6.7873.

This outlook is negated if the bears force a breakdown of the 6.7440 floor. The initial target of this move would be the 6.7371 price mark (61.8% Fibonacci extension and 19 July low), followed by the 29 July low at 6.7276, which also corresponds to the 78.6% Fibonacci retracement level. 6.7193 is the 17 May low/11 July high that constitutes an additional downside target, while 6.7000 is the psychological support that enters the mix on a steep price deterioration.

USD/CNY: 4-hour Chart