- Summary:

- The USD/CNY price is consolidating at an important resistance as tensions between China and the US rise. What next for the Chinese yuan?

The USD/CNY price is consolidating at an important resistance as tensions between China and the US rise. The USD to yuan exchange rate is also in a tight range ahead of the upcoming Fed interest rate decision scheduled for Wednesday. It is trading at 6.7673, where it has struggled to move above in the past few days.

FOMC decision ahead

The main catalyst for the USD/CNY price will be the upcoming Fed decision that will come out during the American session. The bank is expected to deliver another giant rate hike of either 0.75% or 1%. The Fed has already increased rates by 150 basis points this year as it struggles to fight the soaring inflation. These hikes have helped push the US dollar to the highest point in more than two decades.

The USD to yuan exchange rate has also soared because of the performance of the Chinese economy. However, recent data show that the country is struggling. For example, it expanded at the slowest pace since 2020 in Q2 because of the Covid-19 pandemic. At the same time, the country’s real estate sector is imploding, with companies like Evergrande struggling.

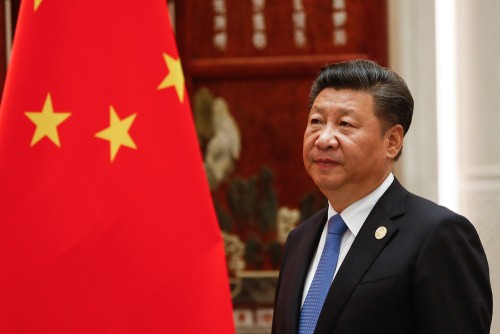

The pair is also rising as investors react to the ongoing tensions between the US and China. A key thorn in the flesh is the announcement that House Speaker Nancy Pelosi will visit Taiwan in the next few weeks. China has claimed Taiwan, and there are signs that the country will invade in the coming years.

USD/CNY forecast

The four-hour chart shows that the USD/CNY price formed a symmetrical triangle pattern that is shown in blue. It managed to move above its upper side on July 14th. Now, the pair is trading at 6.7670, which is a notable level since it has failed to move above it several times this month.

The pair is being supported by the 25-day moving average and the Ichimoku Kinko Hyo. At the same time, the Relative Strength Index (RSI) has moved above the neutral point at 50. Therefore, as I wrote in my previous USDCNY forecast, the pair will likely keep rising as buyers target the resistance at 6.800. A drop below the support at 6.7412 will invalidate the bullish view.