- Summary:

- The USD/CHF is trading higher as the fears of a global recession and monthly drop in Swiss CPI push the greenback above the Swissy.

The USD/CHF has had a big move to the north this Tuesday, as fears of global recession generated heavy safe-haven demand for the greenback. The pair is trading 0.95% higher, notching the third day of gains.

Inflation data from Switzerland came in better than expected but showed an overall drop from previous levels. Consumer Price Index (m/m) in Switzerland increased by 0.5% in June 2022, reaching 104.5 points. This translated to annualized inflation of +3.4% compared with the same month last year. The market expected a 0.3% monthly increase.

The data piece was lower than the monthly inflation figure for May 2022, which gave a higher print of 0.7%. The drop in inflation month-on-month dampened the market’s rate hike expectations from the Swiss National Bank, allowing the greenback to gain an advantage over the Swissy in the battle of safe-haven currencies.

USD/CHF Forecast

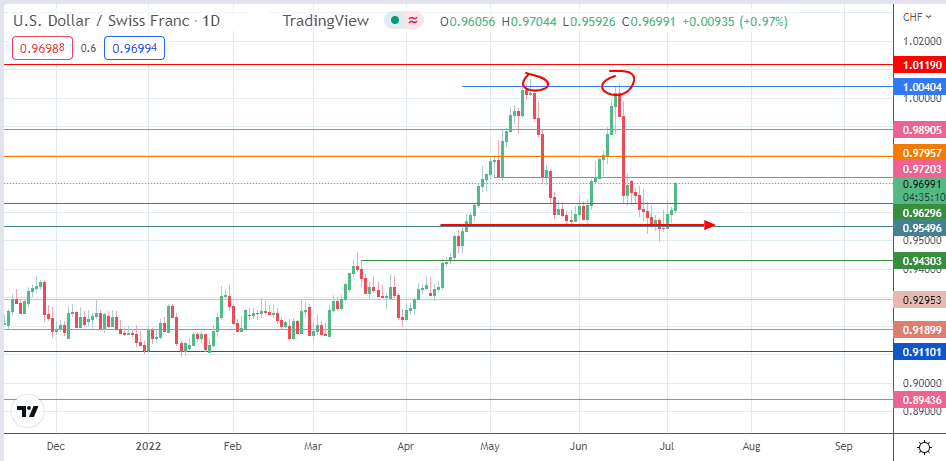

The bounce on the 0.95496 support level (neckline of emerging double top) and subsequent breach of the 0.96296 resistance has put off the expected downside break of the neckline and resolution of the emerging double top pattern. The 4 May/8 June lows at 0.97203 are now the

target for additional bullish action. A clearance of this barrier takes the pair higher, putting 0.97597 (3 May high) in its crosshairs. 0.98905 (5 May high) and the double top’s location at 1.00404 are the other targets the bulls may aim for in the short term.

On the flip side, the bears would ultimately be seeking a decline below the neckline at 0.95496. The breakdown of this price mark completes the topping pattern and opens the door for a potential measured move that

targets the 0.91899 support (16 December 2021 and 17 February 2022 lows). This move must involve a breakdown of pivots at 0.94303 (17 March 2021 high) and 0.92953 (12 April 2022 low). The neckline’s break may come off rejection at any of the mentioned resistance barriers.

USD/CHF: Daily Chart