- Summary:

- The USD/CAD has recovered from earlier losses on lower crude oil prices and a better-than-expected manufacturing PMI print.

The USD/CAD is trading higher today after reversing initial losses earlier in the London session. The New York session has brought a reprieve for the pair after better-than-expected US ISM Manufacturing PMI data hit the newswires.

The latest release from the Institute of Supply Management on the business conditions within the US manufacturing sector indicates that the Purchasing Managers’ Index fell slightly from 53.0 to 52.8 in July 2022. This was not as bad as predicted, as analysts had expected a drop to 52.3. The USD+ve data has allowed the greenback to recover some ground against the Loonie on this Civic Day holiday in Canada.

Also putting pressure on the commodity-linked Loonie is the 3.66% drop in the price of crude oil this Monday. US West, Texas Intermediate crude fell even more steeply and is down 5.6% in NYMEX trading.

The pair will face several fundamental triggers this week, but the top news release of note is the double employment report from the US and Canada on Friday, 5 August. The US economy is expected to add fewer public sector jobs than the previous month (250K v 372K in June), with the unemployment rate remaining static. On the other hand, the market expects Canada to have added 18.2k jobs in July, with the unemployment rate rising from 4.9% to 5.0%.

The USD/CAD is up 0.22% as of writing.

USD/CAD Forecast

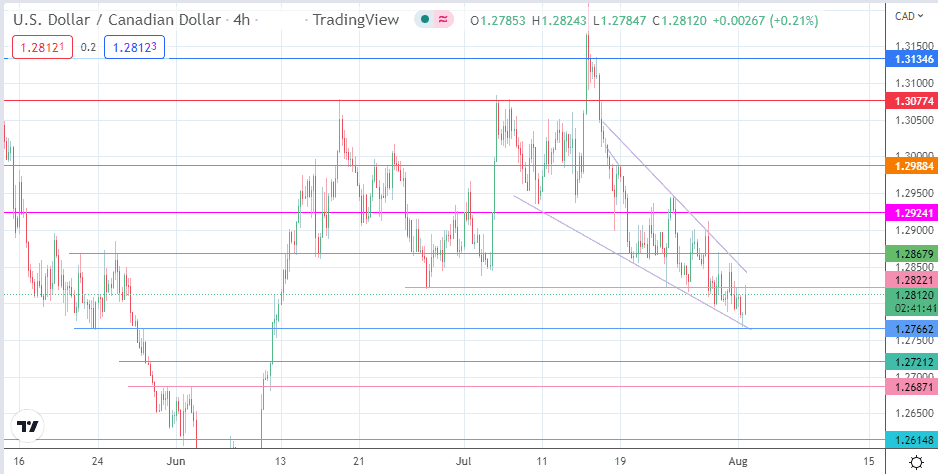

The price candle on the 4-hour chart is testing resistance at 1.28221. A break of this level and the 1.28679 barriers above it complete the falling wedge pattern. The measured move’s completion point rests at 1.30774 (5 July high). To attain this price point, the bulls must clear the resistance barriers at 1.29241 (11 May low/30 June high) and 1.29884 (19 July high).

On the flip side, rejection at 1.28221 and subsequent breakdown of the 1.27662 support by the pullback move results in an invalidation of the wedge pattern. This creates a pathway for the bears to target the 1.27212 price mark (29 May low) before 1.26148 (7 June high) emerges as the next harvest point in line for the bears.

USD/CAD: 4-hour Chart