- The USD/CAD price retreated sharply during the Asian session as investors waited for the upcoming US GDP data and Jerome Powell speech.

The USD/CAD price retreated sharply during the Asian session as investors waited for the upcoming US GDP data and Jerome Powell’s speech. As a result, the USD to CAD exchange rate dropped to a low of 1.2820, the lowest point since last Friday. This price is about 1.63% below its highest point this week.

US GDP data and Powell speech

The USDCAD price dropped after the US published mixed economic data on Tuesday. The Conference Board said that the country’s consumer confidence crashed to a 9-year low of 98 in June. There’s a good reason for this drop. Consumer inflation has jumped to the highest point in over four decades while most people have seen the value of their 401(k) evaporate.

At the same time, wages are growing at a slower pace than inflation. In addition, the cost of housing and mortgages has gone through the roof while gasoline prices are trading at the highest level on record. Therefore, a lower consumer confidence level poses a strong danger to the American economy.

The next key catalyst for the USD/CAD price will be the upcoming US GDP data that is scheduled for Wednesday afternoon. Economists polled by Reuters expect the data to show that the country’s economy contracted by 1.5% in Q1 after expanding in the previous quarter. This contraction happened as consumer and business confidence dropped.

The USD to CAD exchange rate will also react to the latest speech by Jerome Powell. The Fed Chair is expected to reiterate that the bank will continue hiking interest rates despite the economic weakness. The Bank of Canada has adopted a similar hawkish stance.

Still, the GDP data and Powell’s speech will likely not significantly impact the US dollar. For one, the GDP numbers are the third estimates, meaning that investors have a clear picture of what to expect. Similarly, the market knows what the Fed will do in the coming months. As such, the pair will show some volatility if the Fed Chair changes tune.

USD/CAD forecast

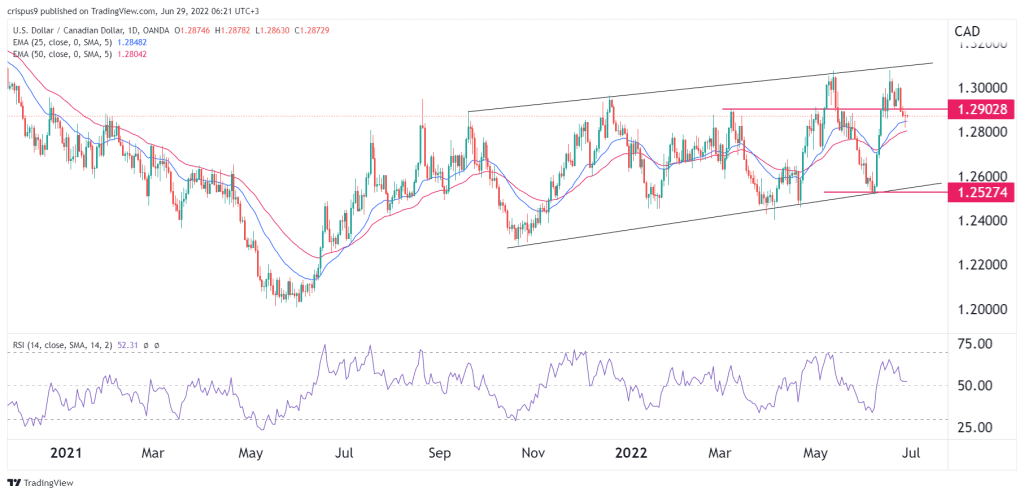

The daily chart shows that the USD to Canadian dollar pair has made a sharp reversal in the past few days. In this period, the pair has dropped from this week’s high of 1.3080 to the current 1.2876. In addition, it has dropped below the upper side of the ascending channel, that is shown in black.

At the same time, the Relative Strength Index (RSI) has tilted lower while the pair has dropped below the important support at 1.2902. Therefore, the pair will likely continue falling as sellers target the lower side of the channel at 1.2527. On the flip side, a move above this week’s high at 1.3082 will invalidate the bearish view.

USD to CAD support and resistance levels

The bearish view is supported by the highly accurate InvestingCube’s support and resistance levels. The indicator has a negative outlook and expects the pair to drop to 1.2850 and 1.2835. The stop-loss for these signals are at 1.2905 and 1.2930, as shown below. Subscribe to the S&R indicator here.