- Summary:

- US ISM Manufacturing data for the month of August drops below market expectations, providing a little respite for the battered EURUSD pair

The Institute of Supply Management (ISM) has released its latest manufacturing business survey result, also known as the ISM Manufacturing PMI. The figure came in at 49.1, which was below the market consensus figure of 51.2.

This figure adds to other data which is showing a contraction in US manufacturing. In response to the news release, the EURUSD has posted a modest 40-pip recovery from the day’s lows and is now trading at 1.09686.

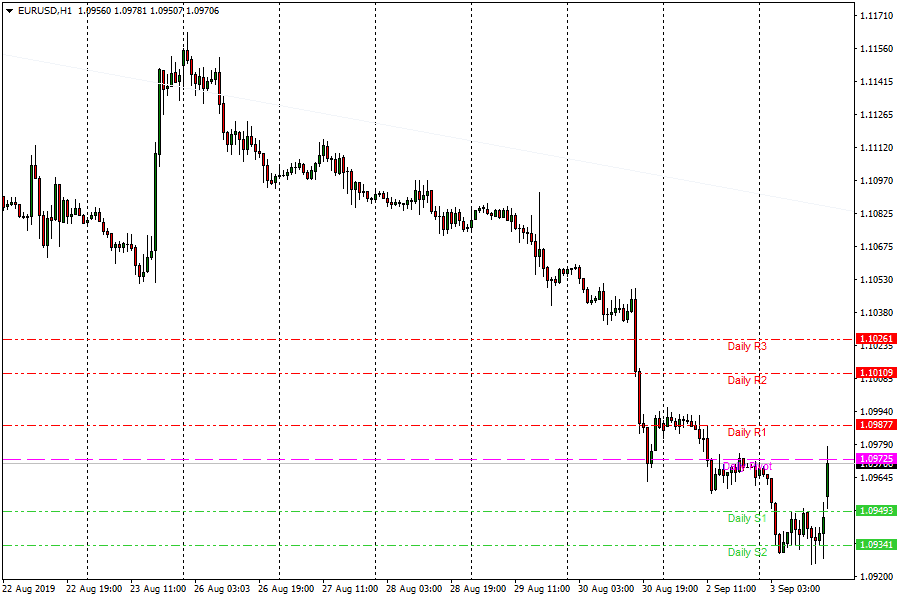

Technical Play: EURUSD

The Fibre has been sold off hard in the last two days on the back of the expected stimulus package announcement by the European Central Bank. The sentiment for the EURUSD is still bearish and the negative news from the US would only be good to boost prices to cheaper levels for those ready to sell.

A trace of the Fibonacci retracement tool from the swing high of 5th August to today’s swing low shows that the next medium-term resistance will be found at 1.1047. But before then, near-term resistance is found at 1.0987. If price is able to break above 1.0987, 1.1047 will then come into focus. However, it would require a great sentimental shift for EURUSD to keep pushing higher.

On the flip side, failure to break above 1.047 may open the door for possible downtrend resumption, which would then target 1.0987 and 1.0934.