- Summary:

- Equities in Wall Street finished higher, extending the rally they initiated yesterday as investors remained hopeful the Fed will lower interest rates

Equities in Wall Street finished higher on Wednesday, extending the rally they initiated yesterday as investors remained hopeful the Fed will lower interest rates before the end of the year. The Dow closed 207 points higher, powered by a combination of short-covering and as market focus shifted from trade concerns to interest rates policy after Fed chair Jerome Powell signaled the central bank would be open to easing monetary policy in order to save the US economy. Today we have received mixed macro data, first the ADP, private sector payrolls increased by only 27k (consensus: 178,000) in May, for the lowest initial estimate since the September 2010. Later today, the Institute for Supply Management’s non-manufacturing index revealed that the US services sector expanded at a faster rate than expected in April. The index rose to 56.9 in May from 55.5 in April, while business activity in the sector rose to 61.2 from 59.6 in April, its 118th consecutive month of expansion.

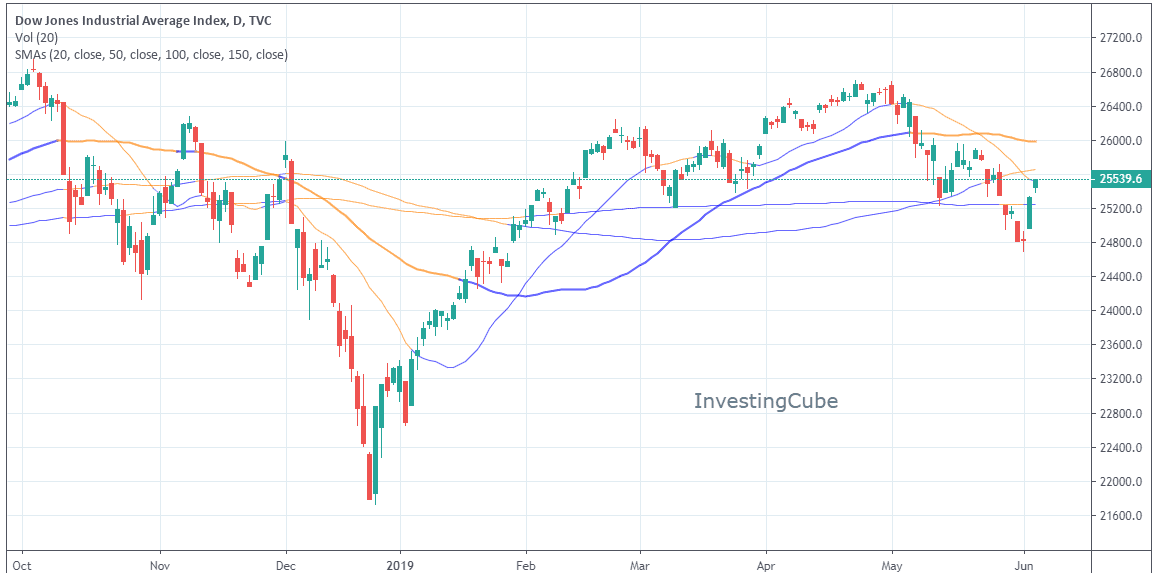

On the technical side, the bias is neutral as Dow managed to close just above the 20 day moving average giving a deep breath for the bulls which in order to regain control must breach the 100 day moving average at 25,658 on a closing basis. On the downside strong support can be met at the 150 day moving average.