- Summary:

- US GDP data for the 2nd quarter came in at 2.0%, the same sas the market forecast but lower than thatof last month. This has created a no-trade scenario, and will allow the USDJPY and USDCHF to be traded on the basis of risk -on/risk-off sentiment

The preliminary US GDP data for the 2nd quarter of 2019 has just been released and it came in at 2.0%, which was the same figure that analysts had predicted. Other news data with low market impact were also released at the same time.

Initial Jobless Claims came in at 215,000, which was also the figure that was forecast by analysts. Goods Trade Balance came in at $-72.3billion, which was slightly better than the market consensus number of $-74billion.

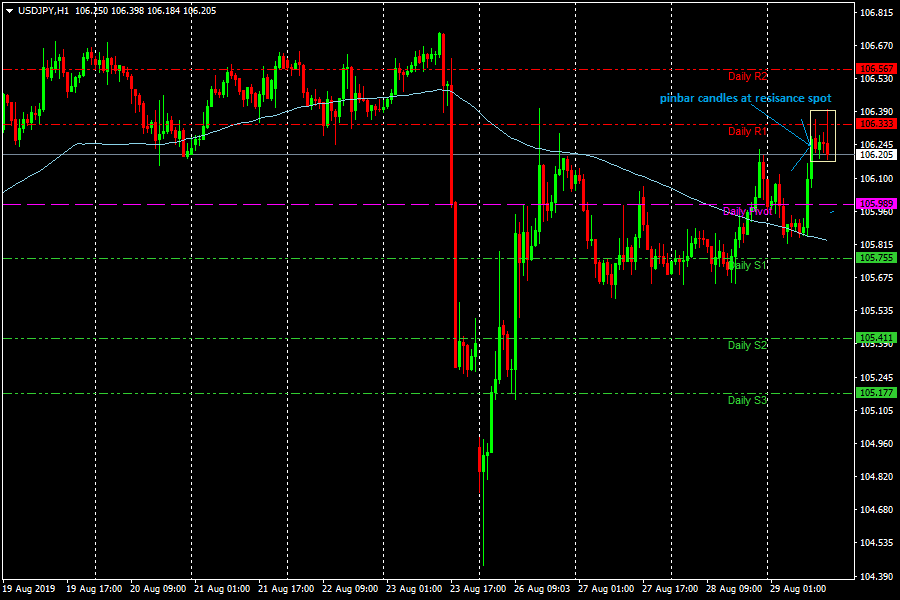

The USDJPY was unmoved by the news releases and continues to trade around the R1 pivot price of 106.34 as at the time of writing.

US GDP Data: Tradable or Not?

It must be stated that the news release required a deviation between the actual number and the consensus figure of at least 0.1%, and since this did not happen, the US GDP data release is considered a no-trade by market standards. Other indices such as trade balance and the initial unemployment claims did not mount enough pressure as to cause market volatility in response to the news.

With no other high-impact news release scheduled for today, traders can now focus primarily on other market events that will produce a risk-on or risk-off sentiment, which can produce trading opportunities in the USDJPY or USDCHF pairs.