- Summary:

- The US dollar index (DXY) continued its upward trend on Wednesday as investors wait for the latest FOMC minutes and US GDP data.

The US dollar index (DXY) continued its upward trend on Wednesday as investors wait for the latest FOMC minutes and US GDP data. The index is trading at $96.47, which is a few points below this week’s high of $96.57. It has jumped by more than 7% from its lowest level this year.

The Federal Reserve will publish minutes of its past monetary policy meeting on Wednesday. These minutes will provide more color about how the committee made its decision three weeks ago.

In this meeting, the bank decided to leave interest rates unchanged between 0% and 0.25%. The bank also decided to start winding down its quantitative easing policy. The minutes will come two days after Powell was reappointed as the Fed chair.

The US dollar index will also react mildly to the second reading of the US GDP data by the statistics agency. Economists expect the data will show that the economy expanded by about 2% in Q3. This being the second reading of the data, the impacts on the DXY will be relatively muted.

Other key catalysts for the dollar index are the upcoming initial jobless claims numbers, durable goods data, and the personal consumption expenditure (PCE) data.

US dollar index prediction

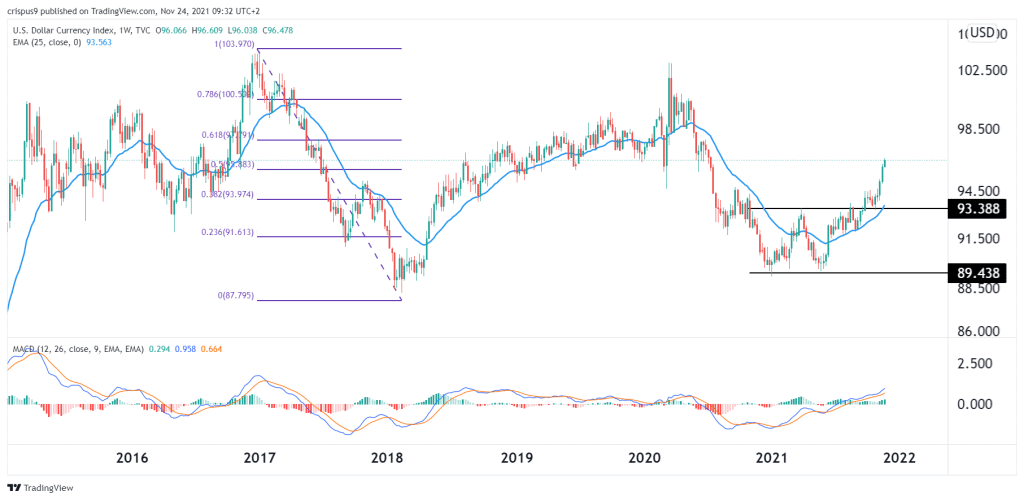

The US dollar index has been in a strong bullish trend. Indeed, the weekly chart shows that the index has jumped in the past seven consecutive weeks. It has also moved above the important resistance level at $93.38, which was the highest level in March.

The pair has also risen above the 25-week and 50-week moving averages while the MACD has moved above the neutral level. It has also moved above the 50% retracement level.

Therefore, the DXY will likely keep rising as bulls target the key resistance level at $97.83. This view will become invalid if the index crashes below $93.38.