- Summary:

- US core durable goods orders surprised the markets to the upside, coming in at 1.2% as against the 0.2% that the market was expecting. USDJPY pulls up.

The US core durable goods orders as well as the durable goods order data for the month of June have been released by the US Census Bureau. The market consensus was for the durable goods order itself to have improved from -1.3% to 0.8%. This figure came in at 2.0% which was better than the expected figure.

Also, the Core durable goods orders (i.e. durable goods minus transportation items), which is the market mover of the 2 releases, came out at 1.2% which was better than the expected figure of 0.2%. It was also a vast improvement on the previous number of 0.4%.

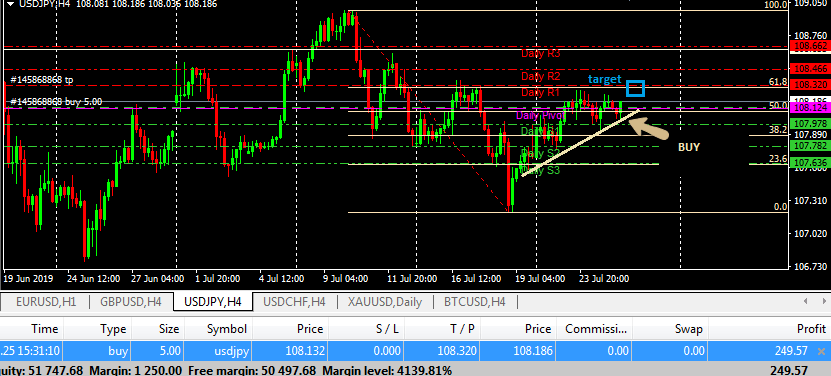

Trade Setups on the USDJPY

After trading in a range for 2 daily sessions, the USDJPY has responded to the news release very positively. The deviation between the actual numbers and the consensus numbers are positively greater than the deviation between the previous numbers and the consensus numbers, which makes both news releases tradable.

The trade here is to buy the USDJPY and follow it to the nearest resistance level. A look at the USDJPY chart will show that price was previously being supported by an ascending trendline on the 4-hour chart, which connects this week’s lows. The trade would naturally be to buy off this trendline and follow the expected upside response of the USDJPY to the next target at the R1 pivot. A trailing stop can be deployed to protect any unrealized profits.

I have an active position on USDJPY which is currently in unrealized profits. This position will be protected by a trailing stop.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.