- Summary:

- The recovery move will depend on an overall recovery of the DeFi market, according to the latest Uniswap price prediction.

Bullish Uniswap price predictions are starting to emerge as the UNI/USDT pair gains 2.7% on the day. This adds to the 14.34% gain seen in the pair on Monday, enabling the stock to record the third day of gains in four. The recent uptick followed a bounce on the 4.6359 support, which marked the 2nd lowest that the Uniswap token has ever been.

The last week has been good for Uniswap. Trading volume broke the $1 trillion mark, enabling the token to push off the current lows. However, the general DeFi market suffered and has been unable to sustain any price rallies recently. The DEX platform has only witnessed 3.9 million wallets despite achieving this milestone.

Apart from the Ethereum, Polygon and Arbitrum blockchains that support Uniswap, expansion to the Polkadot-based parachain Moonbeam and the Gnosis Chain is on the horizon. Both blockchains are compatible with the Ethereum Virtual Machine (EVM).

Uniswap continues to dominate the decentralized exchange market with a 33% market share. PancakeSwap comes in at second place with only a 17.3% market share. However, the trade volume carried by the Uniswap v 3.0 DEX platform still trails heavily behind those of Binance and FTX. Indeed its trading volume is less than 10% of what Binance commands.

The UNI/USDT pair still has a long way to get anywhere near its all-time highs. A strong recovery in the DeFi market is required to generate sustainable bullish Uniswap price predictions.

Uniswap Price Prediction

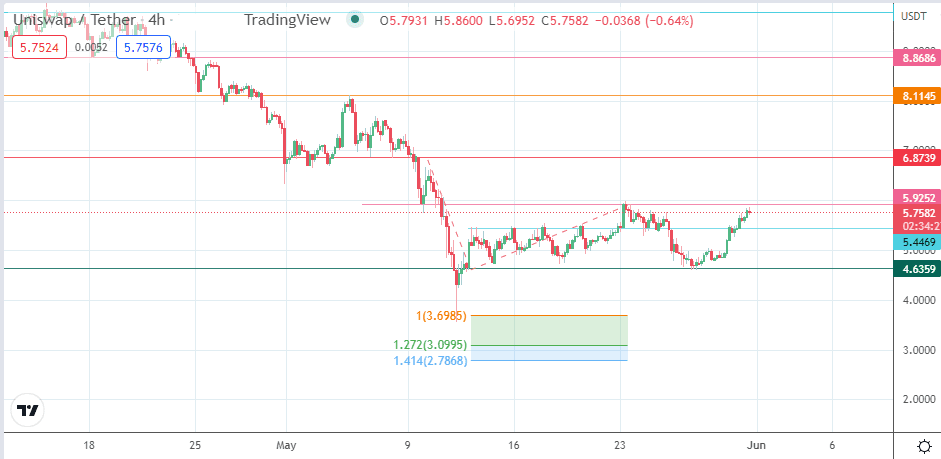

The latest advance appears to have stalled at the 5.9252 resistance, with the 4-hour candle appearing as a doji. This could provide some fuel for the bears to initiate a pullback, targeting 5.4469 initially. However, a further decline brings the 5.0000 psychological price level into focus (29 May high) before 4.6359 enters the mix as an additional downside target.

Below this level, the 12 May 2022 low at 3.5522 forms a potential pivot, while Fibonacci extension levels at the 127.2% and 141.4% levels (3.0995 and 2.7868, respectively) form additional southbound targets.

Conversely, a break of 5.9252 sends the pair towards the 6.8739 resistance. Additional barriers are seen at 8.1145 (5 May 2022 high) and at 8.8383 (26 April 2022 high). Any additional recovery beyond this point appears slim in the short term.

UNI/USDT: Daily Chart