- Summary:

- The Uniswap price has spent the last month sandwiched between between the key moving averages and trend line resistance.

The Uniswap price has spent the last month sandwiched between the key moving averages and trend line resistance. Uniswap (UNI) gained just 6.5% in October despite the cryptocurrency market surging to a $2.7 Trillion valuation. This morning, UNI is trading at $25.40 (-0.91), with a market cap of $15.8 billion. As a result of the recent lethargy, Uniswap is now the 14th-largest crypto asset behind Terra (LUNA).

Decentralized Exchange (DEX) Uniswap is a prominent Decentralized Finance player. The trading venue currently has a Total Value Locked (TVL) of $5.6 billion and is the fourth-largest DEX behind Curve (CRV), SushiSwap (SUSHI) and PancakeSwap (CAKE). However, whilst the TVL of Curve and SushiSwap are at record highs, Uniswap currently has $4b fewer assets than in May. Subsequently, the price has underperformed its rivals and struggling to punch through on the upside. Despite the failure to breakout, Uniswap continues to grip the 100 and 200-day moving averages. However, the longer it takes to clear resistance, the greater the odds of a reversal into the teens.

UNI Price Analysis

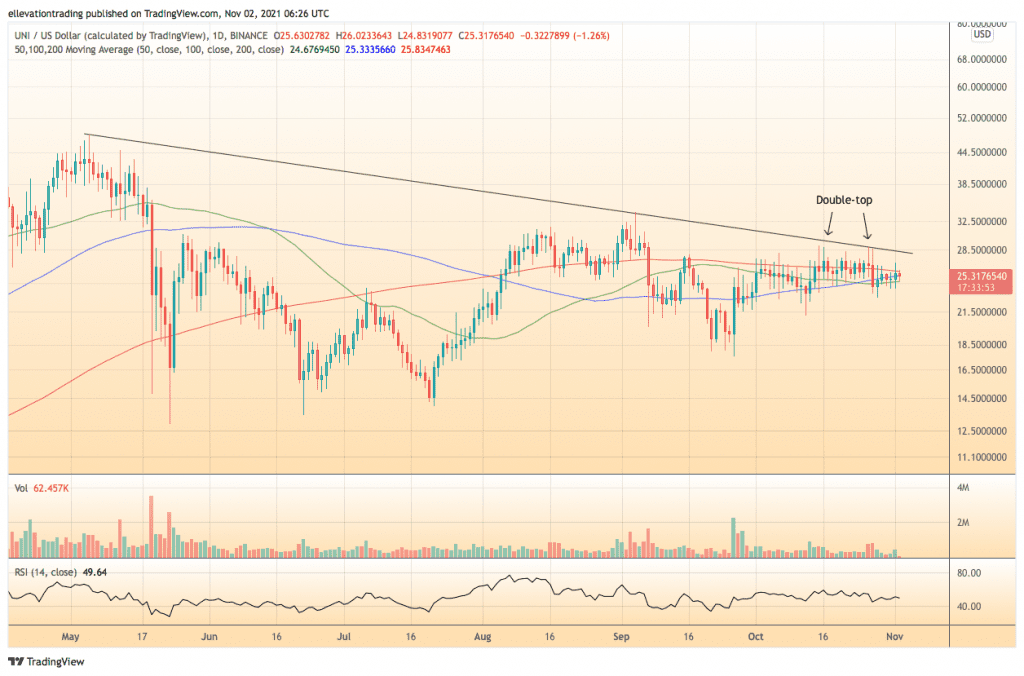

The daily chart shows a descending trend line currently caps the Uniswap price at $28.30. Furthermore, the last two failed attempts to clear the trend have left a bearish double-top formation. As a result, the price has retreated below the 200-DMA at $25.85. However, for now, the 100-DMA at $25.33 supports the price. If UNI loses the support of the 100-DMA, a bearish extension towards the October low at $21.17 looks likely. At the same time, a deeper sell-off could target the September trough, below $18.00

Until the price clears trend resistance, It should trade with a bearish bias. Furthermore, the bearish momentum should increase below the 200-DMA. In my opinion, considering the capital flight from Uniswap, the downside looks favourable. However, a close above trend resistance at $28.30 invalidates this view.

Uniswap Price Chart (Daily)

For more market insights, follow Elliott on Twitter.