- The Uniswap price is rolling over on Tuesday and may soon breach Friday's low, setting up a return to the July trough.

The Uniswap price is rolling over on Tuesday and may soon breach Friday’s low, setting up a return to the July trough.

Uniswap (UNI) is trading at $19.80 (-2.20%), down over 20% in November and almost 60% below the all-time high. The decentralized exchange’s (DEX) market cap has slumped to $12.5 billion, ranking it the 18th most-valuable cryptocurrency ahead of Polygon.

Unlike many cryptos that made new highs recently, Uniswap has been languishing in a broad sideways channel since the crypto-crash in May. Even China’s cryptocurrency ban in September was unable to spark a sustained rally. As a result, investors have shunned the UNI token in favour of fast-moving layer-1 and Metaverse coins. Furthermore, recent research shows that around half of Uniswaps liquidity providers are losing money, which could drive capital and liquidity from the platform.

UNI Price Analysis

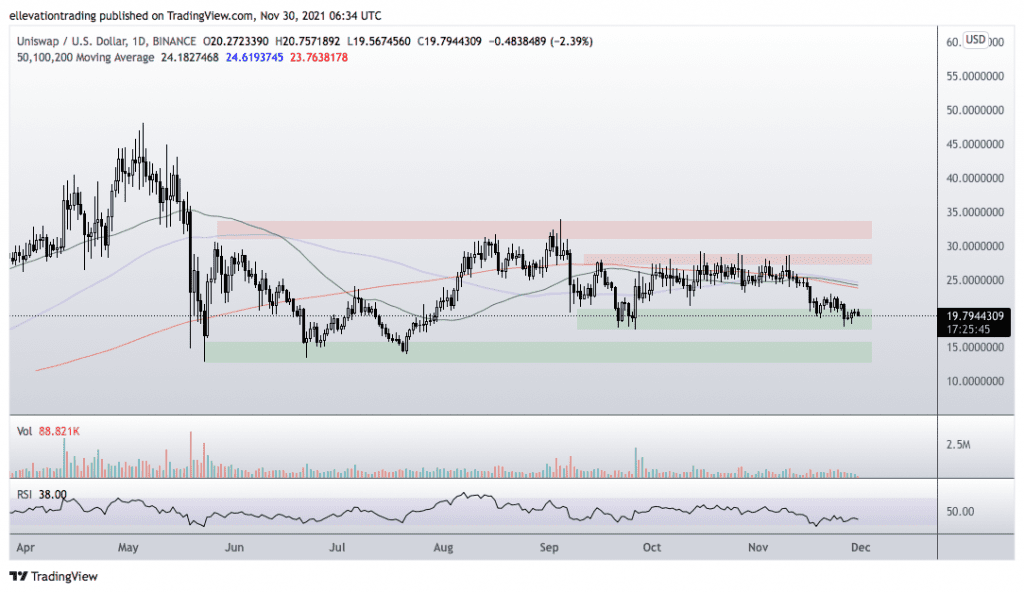

The daily chart paints a depressing picture for the Uniswap price. At the time of writing, UNI is probing lower towards the support of the September low at $17.60. And in my opinion, a close below $17.60 could result in an extension into the $13.00-$16.50 range.

But even if Uniswap turns higher from the current level, the 200-Day Moving Average at $23.76 is a significant obstacle. On that basis, as long as the price remains below $23.76, I expect the downside to prevail, targeting $13.00.

However, successful clearance of the 200-DMA would suggest a bullish reversal, invalidating the bearish view.

Uniswap Price Chart (daily)

For more market insights, follow Elliott on Twitter.