- The Unilever share price has crawled back after the relatively strong earnings by Procter & Gamble. What next for ULVR

The Unilever share price has crawled back after the relatively strong earnings by Procter & Gamble. The ULVR stock is trading at 3,517p, significantly higher than last week’s low of 3,358p. In New York, the UL stock price is trading at $45.54, higher than its lowest level this month. Other consumer staples stocks like Colgate-Palmolive and Estee Lauder have all risen.

P&G earnings boost consumer staples

The Unilever stock price rose after the positive results by P&G. The company’s revenue jumped to $19.37 billion, which was $687 million higher than what analysts were expecting. In addition, the firm’s earnings-per-share rose to $1.33, which was also better than what analysts were expecting. Most of this growth came from the United States, where organic sales rose by 11%. Chinese business declined because of the Covid-19 pandemic, while Europe and Latin America’s revenue rose by 18% and 16%, respectively.

Therefore, earnings by P&G signal that consumer staples companies are doing relatively well even as the cost of doing business rose. Besides, the price of all inputs that the company uses to manufacture its products have risen sharply in the past few months. These firms have also been forced to hike wages in key markets in Europe and the United States.

P&G earnings showed that these companies have pricing power because of their strong brand performance. Unilever has some of the leading brands like Axe, Dove, Lux, Vaseline, Rexona, and Ben & Jerry’s, among others. Indeed, in the past few months, the company has hiked prices of most products mildly. The next key date to watch will be on 3rd May. Analysts expect that the firm’s revenue will decline to about $14 billion.

Unilever share price forecast.

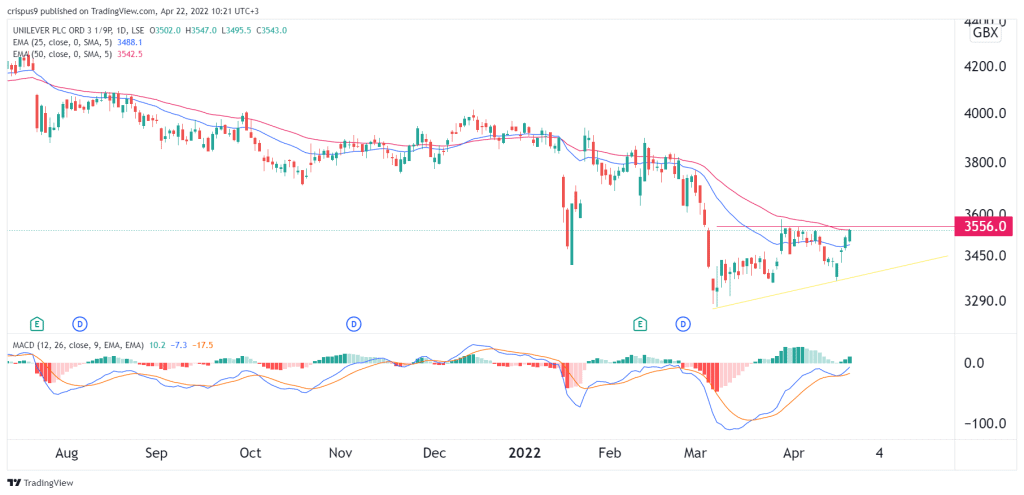

In my last article, I noted that Unilever was a cheap stock. However, the daily chart shows that the ULVR share price has risen in the past four straight days and is approaching the important resistance level at 3,556p. The stock has struggled to move above this resistance several times since March. It has also moved slightly above the 25-day moving average and is at the same point as the 50-day EMA.

Therefore, a move above the key resistance at 3,556p will signal that there are more buyers in the market. If this happens, the next key resistance level to watch will be at 3,650p. A move below the support at 3,500p will invalidate the bullish thesis.