- Summary:

- The Unilever share price dropped by more than 1.6% on Tuesday as sentiment in the retail industry waned. Is it a buy?

The Unilever share price dropped by more than 1.6% on Tuesday as sentiment in the retail industry waned. The ULVR stock declined to a low of 3,643p, which was about 3% lower than its highest level this month. Other FMCG stocks like Procter & Gamble, Coca-Cola, Colgate-Palmolive, and Clorox retreated slightly after the weak Walmart earnings.

Unilever, like other giant FMCG, companies surprised investors when they published strong results recently. While these companies had a difficult quarter, they also pointed to their overall pricing power as inflation costs continued. Unilever has managed to continually increase price without compromising a lot of growth.

In the most recent quarter, the company said that it increased its prices by about 8.3%. The firm was able to do that because of the size of its business. For example, 13 of its products like Sunlight, Omo, and Rexona now generate north of 1 billion euros every year. Analysts also believe that the company will benefit with the price increases even when the current logistics and raw material challenges end.

Still, some analysts are worried about Unilever. In a note, those at Societe Generale warned: “Frustratingly, the risk of a structural sales slowdown, at an ever-decreasing margin, is back in view. For now, we see no route to better leverage its key assets via heightened exposure to future-proofed market segments.”

While Unilever’s business is seeing challenges, the stock is relatively cheap. For one, it has a TTM PE multiple of 17.41, which is lower than the sector average of 21.20. Similarly, it has a forward EV to EBITDA of 12.67, which is slightly above the sector median of 12.20. Notably, its dividend yield of 4.4% is above the average of 2.22%.

Unilever share price forecast

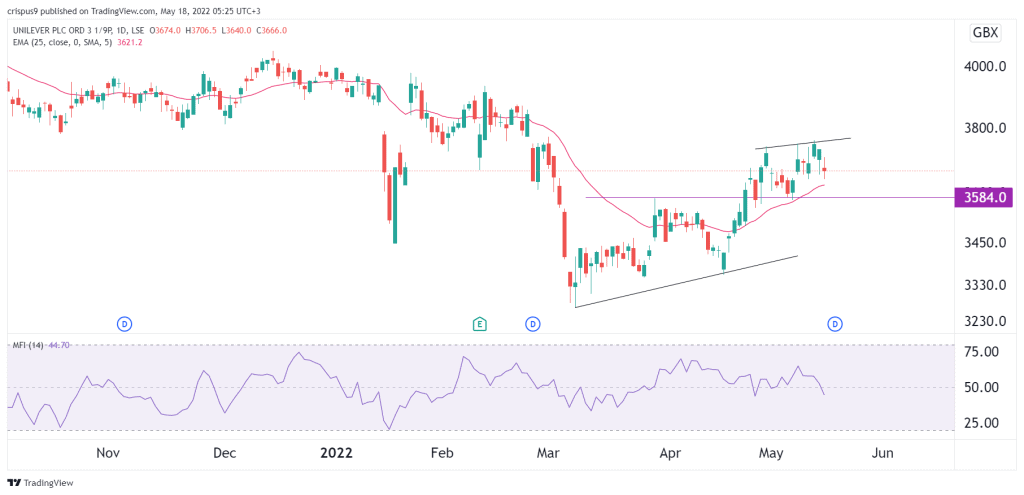

The daily chart shows that the ULVR share price formed a sliding double-top pattern recently. It has moved slightly below last week’s high of 3,762p. Along the way, the shares have moved above the 25-day moving average while the Relative Strength Index (RSI) has moved slightly below the neutral level of 50.

I suspect that the stock will continue falling in the near term as bears target the important support level at 3,584p. This is a notable level since it was the highest point on March 29th this year. The stop-loss of this trade will be at last week’s high at 3,758p.