- Summary:

- The Unilever share price has struggled substantially in the past few months as concerns about the company’s margins remain.

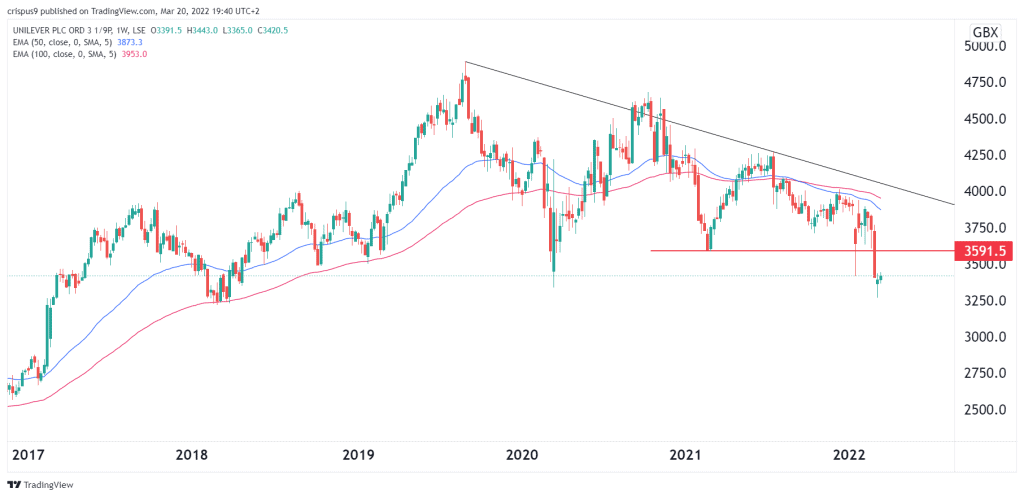

The Unilever share price has struggled substantially in the past few months as concerns about the company’s margins remain. The ULVR stock is trading at 3,420p in London, about 20% below the highest point in 2021. It is also slightly above its year-to-date low, equally the lowest level since April 2018.

Unilever has had a rough patch in the past few months. The challenges accelerated when the company attempted to spend billions of pounds acquiring GSK’s consumer health products. Analysts and investors rebuffed the acquisition as a desperate move towards empire-building. Internally, Unilever has faced additional challenges. As a consumer staples firm, its margins are thinning as the cost of doing business rises.

Some of its critical inputs like cotton have seen their prices jump. Similarly, the ongoing global inflation pressures, including wages, have made it difficult for the firm. Still, Unilever’s share price has underperformed other companies like Procter & Gamble, Estee Lauder, Colgate-Palmolive, and Coty. As a result, its dividend yield has jumped to 4.13%, which is more than double that of P&G. Its forward dividend yield of 4.30% is also higher than most of its peers.

For starters, a high dividend yield can be risky because it happens when a stock is under pressure. Still, despite the challenges, the company’s dividend is pretty safe and has room for growth. Unilever’s PE ratio has also gotten so cheap. It has a PE ratio of 17, which is lower than PGs 26.

Some analysts believe that Unilever is a good turnaround stock. They point to the fact that it is raising prices of its top products and that it has a strong market share. Still, critics argue that the company has become a laggard in the past few years.

Unilever share price forecast

The weekly chart shows that the ULVR share price has been under pressure in the past few months. The stock even moved below the key support level at 3,591p, which was the lowest level on 15th February last year. It has formed a descending triangle pattern and moved below the longer-term moving averages. Therefore, by retesting the lower side of the triangle, it means that the stock will likely continue falling in the near term. The next key support level will be at 3,000p.